Are there material average performance differences between hedge funds that emphasize systematic rules/algorithms for portfolio construction versus those that do not? In their December 2016 paper entitled “Man vs. Machine: Comparing Discretionary and Systematic Hedge Fund Performance”, Campbell Harvey, Sandy Rattray, Andrew Sinclair and Otto Van Hemert compare average performances of systematic and discretionary hedge funds for the two largest fund styles covered by Hedge Fund Research: Equity Hedge (6,955 funds) and Macro (2,182 funds). They designate a fund as systematic if its description contains “algorithm”, “approx”, “computer”, “model”, “statistical” and/or “system”. They designate a fund as discretionary if its description contains none of these terms. They focus on net fund alphas, meaning after-fee returns in excess of the risk-free rate, adjusted for exposures to three kinds of risk factors well known at the start of the sample period: (1) traditional equity market, bond market and credit factors; (2) dynamic stock size, stock value, stock momentum and currency carry factors; and, (3) a volatility factor specified as monthly returns from buying one-month, at‐the‐money S&P 500 Index calls and puts and holding to expiration. Using monthly after-fee returns for the specified hedge funds (excluding backfilled returns but including dead fund returns) during June 1996 through December 2014, they find that:

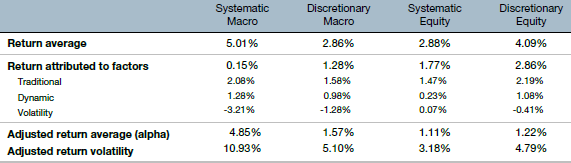

- On average over the sample period, both Equity Hedge and Macro hedge funds generate positive net alphas (see the table below).

- Regarding Equity Hedge funds on average:

- Systematic Equity Hedge funds underperform discretionary counterparts based on net excess return, but with lower volatility and similar net alpha (1.1% versus 1.2% annualized, respectively).

- Systematic Equity Hedge funds have much lower exposures to specified risk factors (in other words, much higher diversification potential) than discretionary counterparts.

- Regarding Macro funds on average:

- Systematic Macro funds outperform discretionary counterparts based on net excess return, with higher net alpha (4.9% versus 1.6% annualized, respectively) but much higher volatility.

- Systematic Macro funds have somewhat higher exposures to specified risk factors (in other words, somewhat lower diversification potential) than discretionary counterparts.

- Dispersion of Sharpe ratios across funds within hedge fund styles is similar (and large) for systematic and discretionary funds. In other words, systematic funds are no more homogeneous than discretionary funds.

The following table, extracted from the paper, summarizes average annualized net excess returns, return attributions to the three kinds of risk factors, net alphas and volatilities for systematic and discretionary Macro and Equity Hedge (Equity) funds over the sample period. Results indicate that systematic Macro substantially outperforms discretionary Macro, but systematic and discretionary Equity Hedge funds perform similarly.

In summary, evidence suggests that hedge funds inclined toward systematic portfolio formation are generally competitive with those inclined toward discretionary portfolio formation.

Cautions regarding findings include:

- The text-based fund designation approach may not accurately discriminate between funds that rely principally on rules/algorithms for specifying portfolios and those that are principally discretionary.

- As noted in the paper, risk factor portfolios (especially the dynamic set) are not realistically zero cost. Risk factor returns are therefore overstated.