Does the credit premium, measured by the difference in returns between U.S. corporate bonds and duration-matched U.S. Treasuries, exhibit momentum? In his December 2016 paper entitled “Momentum in the Cross-Section of Corporate Bond Returns”, Jeroen van Zundert tests for momentum of the volatility-adjusted credit premium among U.S. corporate bonds via the following methodology:

- Acquire the monthly total credit premium of each corporate bond as the difference in total (coupon-reinvested) returns between the bond and a duration-matched U.S. Treasury instrument.

- For each bond, divide cumulative total credit premium over the last six months by standard deviation of monthly credit premiums over the last 12 months (something like a Sharpe ratio).

- After inserting a skip-month, sort all bonds on this metric into tenths (decile portfolios), with each bond weighted by the inverse of its volatility.

- Hold each portfolio for six months, computing an overall monthly return as the average for portfolios formed within the last six months.

- Calculate volatility-adjusted credit premium momentum as the gross difference in performance between the top (winner) and bottom (loser) decile portfolios.

To estimate portfolio alphas, he adjusts for six factors (equity market, equity size, equity value, equity momentum, bond term and default risk). In robustness tests, he considers past return measurement and holding intervals of one, three, nine and 12 months. Using total credit premiums, trading volumes and characteristics for a broad sample of U.S. investment grade and high yield corporate bonds during January 1994 through December 2015, he finds that:

- The average monthly credit premium for U.S. corporate bonds is 0.1% over the sample period, ranging from 0.03% for AAA-AA to 0.21% for CCC-C. Volatilities also increase as credit rating decreases.

- Without volatility adjustment, there is evidence of credit premium momentum only among bonds rated CCC and lower (just 6% of the U.S. corporate bond market).

- The range of volatilities for U.S. corporate bonds is large and persistent.

- For example, the future volatility of the tenth of bonds with the highest past volatility is 11.7 times larger than that of the tenth of bonds with the lowest past volatility. The comparable ratio for stocks is about 3.5.

- Bond traders therefore have strong incentive to account for past volatility.

- Volatility-adjusted credit premium momentum exists across credit ratings:

- Overall, the average monthly gross raw return difference between winner and loser portfolios is 0.26%, translating to monthly gross 7-factor alpha 0.27%.

- For an investment grade (high yield) subsample, monthly gross 7-factor alpha is 0.20% (0.38%).

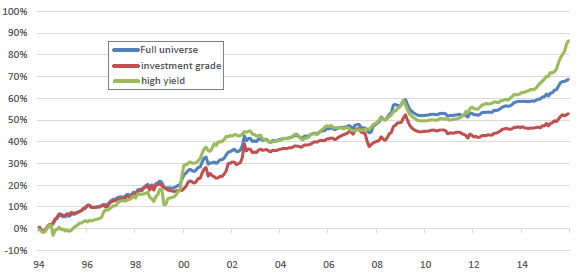

- The effect is fairly persistent over time (see the chart below).

- The effect exists for most other past credit premium measurement and holding intervals, with best gross performance for past return measurement interval 12 months and holding interval one month.

- Results are equally strong for liquid and illiquid bonds as measured by past trading volume.

- The source of momentum in U.S. corporate bonds appears to be underreaction to new information.

The following chart, taken from the paper, shows cumulative performances of volatility-adjusted credit premium momentum for the full U.S. corporate bond sample (universe), and for investment grade and high yield separately, based on past credit premium measurement and holding interval six months. Results indicate that the momentum effect is persistent.

In summary, evidence indicates that the volatility-adjusted credit premium for U.S. corporate bonds exhibits momentum on a gross basis across the credit rating spectrum.

Cautions regarding findings include:

- Results are gross, not net. Accounting for the costs of monthly portfolio reformation and shorting costs for loser bonds would reduce returns. Shorting of loser bonds may not be feasible.

- The volatility-adjusted credit premium model is fairly complex and may impound model snooping. Complex models also offer multiple opportunities for snooping of parameter values (such as the lookback interval for monthly volatility calculation).

- The sample period is not long in terms of variety of inflation and interest rate regimes. Findings may not be robust across the range of potential regimes.

- Reinvestment of coupons on a bond-by-bond basis as assumed may not be practical.

- The authors state that: “The excess returns [credit premium] can be obtained in practice by hedging the interest rate exposure with interest rate swaps or bond futures.” Such an approach would increase execution complexity and frictions.

- Most investors cannot practically construct their own bond portfolios and bear fees for delegating construction to a fund.

See also: