Does momentum not work for Japanese equities? In his March 2011 paper entitled “Momentum in Japan: The Exception that Proves the Rule”, Clifford Asness examines whether the failure of stock price momentum in Japan materially undermines belief in momentum investing. He argues that any such examination should adopt the context of value and momentum as an integrated system. His methodology is to rank stocks representing the top 90% of capitalization within each of the U.S., UK, Europe (excluding UK) and Japan into three equal groups by value (book-to-market ratio, with book value lagged six months) or momentum (12-month past return, skipping the most recent month). The spreads in value-weighted returns between the top and bottom thirds define the value and momentum premiums within each geographic market. Using monthly returns for the selected stocks over the period July 1981 through December 2010 (29.5 years), he finds that:

- The value and momentum premiums are substantial everywhere over the entire sample period, except for momentum in Japan.

- Sharpe ratios associated with the value premium are 0.14 for the U.S., 0.38 for the UK, 0.35 for Europe, 0.71 for Japan and 0.57 for the markets combined. Results are statistically significant, except for the U.S. (Europe is borderline).

- Sharpe ratios associated with the momentum premium are 0.22 for the U.S., 0.48 for the UK, 0.48 for Europe, 0.03 for Japan and 0.38 for the markets combined. Momentum in Japan is effectively zero.

- A portfolio that invests 50% in each market’s value long/short strategy and 50% in that market’s momentum long/short strategy, rebalanced monthly, generates a Sharpe ratio of 0.40 for the U.S., 0.84 for the UK, 0.82 for Europe, 0.65 for Japan and 1.01 for the markets combined. These consistently significant results derive from the negative correlations between value and momentum returns over the sample period: -0.59 for the U.S., -0.47 for the UK, -.050 for Europe, -0.55 for Japan and -0.63 for the markets combined.

- Reasons to conclude that the weakness of momentum in Japan does not represent a failure of momentum overall are:

- The result is consistent with a randomly unfavorable observation within generally pervasive value and momentum effects.

- An integrated value-momentum system is successful in Japan.

- A momentum strategy in Japan has a positive three-factor (market, size, book-to-market) alpha because of the negative relationship between value and momentum returns.

- A Japanese market value-momentum strategy optimizer with perfect foresight would still have given momentum a 30% weight for the sample period.

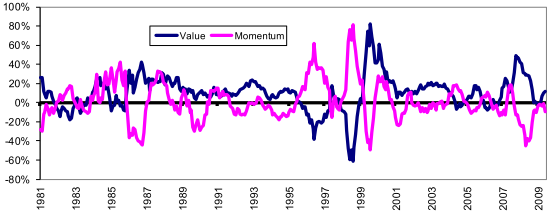

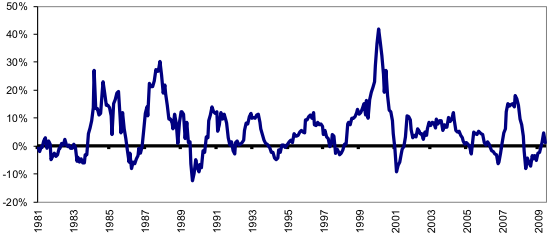

The following charts, taken from the paper, show rolling 12-month returns for the above-specified Japanese value and momentum strategies separately (upper chart) and integrated as a 50%/50% mix with monthly rebalancing (lower chart). The negative correlation between value and momentum returns is evident in the upper chart. Because of this negative relationship, the integrated strategy generates mostly positive outcomes, and the worst case 12-month return for this portfolio is a relatively benign -13%.

In summary, despite weak results in Japan, global evidence for stock return momentum investing is strong, especially when viewed as an integrated system with value investing.

Cautions regarding these findings include:

- The premiums and outcomes described apparently include no trading frictions, which are likely material due to monthly rebalancing of portfolios. Additional rebalancing for integrated value-momentum portfolios likely exacerbates trading frictions.

- Momentum-only investors may want to exclude Japan from their opportunity set as a precaution.