Does playing trends both ways via periodic rebalancing (betting on reversion) and momentum (betting on continuation) reliably produce attractive outcomes? In the August 2014 version of their paper entitled “Rebalancing Risk”, Nick Granger, Doug Greenig, Campbell Harvey, Sandy Rattray and David Zou investigate the effects of adding a momentum overlay to a conventionally rebalanced stocks-bonds portfolio. They note that periodic rebalancing to fixed asset class weights tends to perform well in trendless markets exhibiting mean reversion but suffers during extended trends. They consider simple examples using a 60% target allocation to the S&P 500 Index and a 40% allocation to 10-year U.S. Treasury notes (T-note), rebalanced monthly or quarterly. Their momentum strategy employs a complex daily moving average cross-over model with target volatility 10% that has an average annual turnover of 400%. Using both theoretical arguments and empirical analysis of daily and monthly asset class proxy returns during January 1990 through February 2014, they find that:

- When asset classes diverge strongly in performance over an extended period, fixed-weight rebalancing may underperform buy-and-hold as rebalancing persists in shifting toward an underperforming asset class. During the 2008-2009 and 2000-2002 equity bear markets, monthly rebalancing of initial allocations of 60% to the S&P 500 Index and 40% to T-notes increases maximum drawdowns by about 6% compared to buying and holding the initial allocations.

- A momentum strategy overlay tends to gain from trends that hurt a strategy that periodically rebalances stock and bond allocations to fixed weights, but carries little penalty in other environments. The momentum overlay essentially neutralizes the negative tail in the equities allocation.

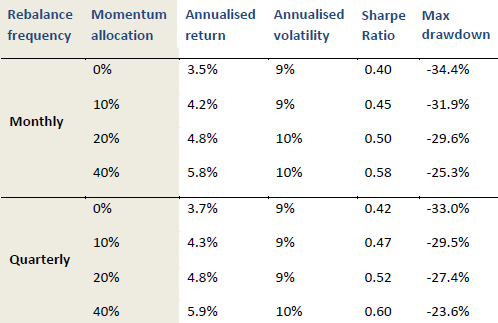

- More specifically, adding a momentum strategy overlay generally increases the gross Sharpe ratio and reduces maximum drawdown for a conventionally rebalanced stocks-bonds portfolio. The larger the momentum strategy overlay, the greater the gross performance improvement (see the table below).

The following chart, taken from the paper, shows the gross performance effects of shifting funds from a base portfolio consisting of 60% S&P 500 Index and 40% T-notes, rebalanced either monthly or quarterly, to a momentum overlay comprising up to 40% of the total portfolio. The sample period is January 2000 through February 2014. For both monthly and quarterly rebalancing frequencies, increasing the momentum strategy allocation generally improves gross annualized return and gross Sharpe ratio, while suppressing maximum drawdown.

In summary, evidence indicates that a momentum overlay enables conventional rebalancing without the risk of increased drawdown.

Cautions regarding findings include:

- The study does not fully specify the momentum strategy employed. The strategy appears to be complex, and such strategies are susceptible to snooping bias from experimentation in selecting multiple parameter values. However, the authors assert that “the essential story remains the same even for simpler momentum models.”

- The study uses indexes rather than tradable assets, ignoring the costs of creating and maintaining liquid tracking funds. Such costs reduce performance.

- The study ignores the trading frictions associated with periodic rebalancing and momentum strategy execution. Accounting for these costs would reduce performance. Moreover, since the momentum overlay involves substantially higher turnover than conventional rebalancing, frictions would increase with the size of the momentum overlay.