Do reversal, momentum and reversion effects hold among German stocks? In his January 2016 paper entitled “Trading Strategies Based on Past Returns – Evidence from Germany”, Martin Schmidt examines the performance of short-term reversal, intermediate-term momentum, long-term reversion and seasonality strategies in the German stock market. The seasonal strategy considers one-month returns from multiples of 12 months ago. His general approach is to each month (1) rank stocks into tenths (deciles) of a specified segment or pattern of past returns and (2) measure the performance next month of a value-weighted or equal-weighted portfolio that is long the top decile and short the bottom decile. For value weighting, he caps weight at 50%. Using monthly prices for a broad sample of German stocks during January 1955 through June 2014, he finds that:

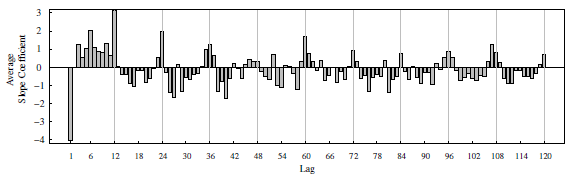

- Simple regressions (see the first chart below) indicate that the relationship between next-month return and:

- Last-month return is strongly negative, confirming a short-term reversal effect.

- Returns from 3 to 12 months ago are positive, confirming an intermediate-term momentum effect.

- Returns from more than 12 months ago are generally negative, except for positive but weakening pulses at multiples of 12 months ago, confirming long-term reversion and seasonality effects.

- Other tests suggest that a short-term reversal strategy may benefit from using return over the last two months.

- Among long-short strategies designed to exploit these effects:

- Returns of short-term reversal strategies are high for equal weighting with microcaps included, but otherwise close to zero.

- Momentum investing earns persistently postive returns.

- Returns of long-term reversion strategies are typically insignificant.

- Seasonality strategies based on returns from multiples of 12 months ago generate gross monthly returns around 1% over the full sample period but zero after 2004 (post-discovery).

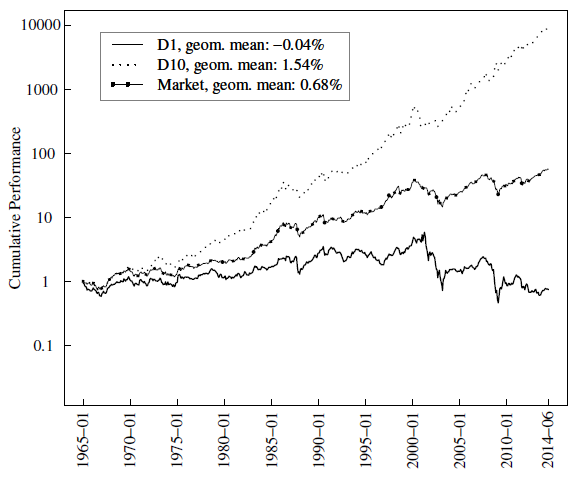

- Focusing on momentum investing (see the second chart below):

- A conventional long-short value-weighted strategy excluding microcaps, ranking by cumulative return from 12 to 2 months ago, generates average gross monthly return 1.57% and gross monthly three-factor (market, size, book-to-market) alpha over the entire sample period. Over the last ten years of the sample, average gross monthly return is 2.27%.

- A modified long-short value-weighted strategy excluding microcaps, ranking by cumulative return from 12 to 3 months ago, generates average gross monthly return 1.48% and gross monthly three-factor alpha 1.69% over the entire sample period. Over the last ten years of the sample, average gross monthly return is 2.97%.

- Monthly portfolio reformation frictions for this strategy (estimated from bid-ask spreads only) are about 0.33% for the long side and 0.53% for the short side (which holds more small stocks than the long side).

- Most of the gross profitability comes from the long side. A long-only portfolio excluding microcaps generates an average gross monthly return of 1.32% (1.05%) based on value (equal) weighting over the entire sample period.

The following chart, taken from the paper, shows average regression coefficients (in percent) of next-month return versus each of monthly returns from 1 to 120 months ago for all stocks over the entire sample period. There is a prominent negative average coefficient for the first lag, indicating short-term reversal. Average coefficients for lagged months 3 through 12 are positive, indicating intermediate-term momentum. Larger lags have mostly negative average coefficients, indicating long-term reversion. However, there are positive pulses at most multiple annual lags (12, 24, 36, 60 and 72), indicating a seasonal effect.

The next chart, also from the paper, tracks gross cumulative performances and compound annual growth rates for the long (D10) and short (D1) sides of the modified momentum strategy (ranking on cumulative return from 12 to 3 months ago) for value weighting excluding microcaps over the entire sample period. It also shows the performance of the value-weighted market as a benchmark. Results indicate that momentum investing usually works for German stocks and the winner contribution is typically much larger than the loser contribution.

In summary, evidence indicates that long-only intermediate-term momentum investing is an attractive strategy for German stocks.

Cautions regarding findings include:

- As noted in the paper, estimated trading frictions may be low, accounting only for bid-ask spreads for a recent subperiod.

- Also as noted in the paper, shorting of loser stocks may not always be possible (no shares to borrow).

- Data collection/processing and portfolio implementation burdens are beyond the reach of many investors, who would bear fees for delegating this work.