Is there a simple way to improve the performance of conventional asset class target allocations by rotating to strength within classes based on Relative Strength Index (RSI)? In his September 2015 paper entitled “Momentum Investing and Asset Allocation”, Drew Knowles seeks to improve the performance of baseline asset class (equity, fixed income, hedge fund) allocations via dynamic intra-class rotation to strength based on RSI. His principal passive benchmark (50/30/20) allocates 50% to equities (S&P 500 Total Return Index), 30% to fixed income (Barclays U.S. Aggregate Index) and 20% to hedge funds (HFRI Fund Weighted Composite), apparently rebalanced annually. For dynamic rotation, he replaces the broad equity, fixed income and hedge fund indexes with, respectively, the apparently equally weighted Top 5 (of 10) S&P 500 sector indexes, Top 5 (of seven) fixed income style indexes and Top 5 (of eight) hedge fund style indexes based on 12-month RSI. He breaks ties in RSI by picking the index with higher return per unit of risk (compound annual growth rate divided by standard deviation of returns) over the same 12 months. Within each asset class, he tests four Top 5 reformation frequencies: annual, semi-annual, quarterly or monthly. He ignores rebalancing/reformation frictions and tax implications of trading. Using monthly data for the selected broad and sector/style indexes during 1991 through 2014, he finds that:

- Regarding optimal (based on gross performance) reformation frequencies for Top 5 indexes:

- For equity sectors, monthly is optimal.

- For fixed income styles, gross performance is insensitive to rebalancing frequency (the author thus selects annual).

- For hedge fund styles, quarterly is optimal.

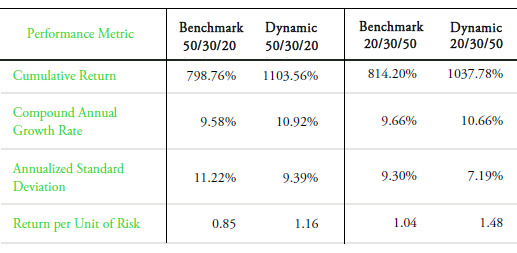

- Applying optimal intra-class sector/style selection frequencies, dynamic rotation to strength generally improves portfolio return and suppresses volatility, whether applied to the principal 50/30/20 passive benchmark or to a 20/30/50 alternative that shifts weight from equities to hedge funds (see the table below).

The following table, extracted from two tables in the paper, compares gross performance metrics for two passive benchmarks to their dynamic, rotation-to-strength counterparts as described above. The dynamic strategy modestly boosts gross return and substantially reduces volatility in both cases.

In summary, evidence indicates that dynamic RSI-based rotation to strength of assets within fixed asset class target allocations outperforms passive versions of the same allocations.

Cautions regarding findings include:

- As stated in the paper, performance results are gross, not net. Creating tradable assets from indexes and reforming asset class holdings at monthly, quarterly or annual frequencies involve trading frictions that would reduce reported returns. Reductions for the dynamic strategy would be greater than those for the passive benchmark.

- Creating assets that are tradable quarterly and match hedge fund style indexes may not be feasible.

- Testing incorporates some optimization of Top 5 reformation frequencies and asset class target allocations. The associated snooping bias produces overstated expectations.

- The equal weighting of sector/style indexes within asset classes may contribute to dynamic allocation outperformance, in addition to or instead of RSI ranking. For example, do the equally weighted Top 5 equity sectors outperform the equally weighted Bottom 5?

- The author does not test for consistency of dynamic strategy outperformance over time.