As a follow-up to “Mutual Fund Hot Hand Performance Robustness Test”, a subscriber suggested testing a portfolio that each year holds the top two Fidelity diversified equity funds plus the top two Vanguard diversified equity funds from “Mutual Fund Hot Hand Performance” (four funds total). Such a portfolio should suppress volatility, particularly the effects of any outlier returns, while maintaining tax-friendly capital gains treatment. We extend that suggestion to consider the top three funds from each of the Fidelity and Vanguard sets. We use June-to-June annual returns starting 1993 with availability of SPDR S&P 500 (SPY) as a widely used and easily investable benchmark. The number of Fidelity (Vanguard) funds available for the initial ranking in 1993 is 23 (10), growing to 61 (49) by 2013. Using monthly total returns for SPY and the Fidelity and Vanguard diversified equity mutual funds as available from Yahoo!Finance during June 1993 through June 2014 (21 years), we find that:

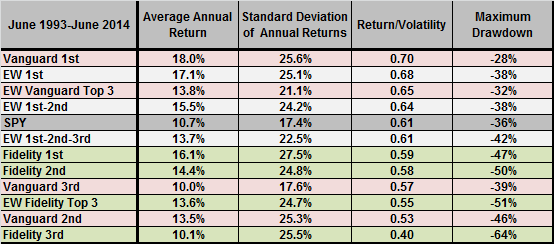

The following table summarizes annual performance statistics for 12 portfolios, ranked by return/volatility (average annual return divided by standard deviation of annual returns) during June 1993 through June 2014 . The 12 portfolios are:

- Vanguard 1st: at the end of each June, allocate all funds to last year’s top Vanguard fund and hold it for a year.

- EW 1st: at the end of each June, allocate equal funds to last year’s top Fidelity fund and top Vanguard fund and hold them for a year.

- EW Vanguard Top 3: at the end of each June, allocate equal funds to last year’s top three Vanguard funds and hold them for a year.

- EW 1st-2nd: at the end of each June, allocate equal funds to last year’s top two Fidelity and top two Vanguard funds and hold them for a year.

- SPY: buy and hold SPY.

- EW 1st-2nd-3rd: at the end of each June, allocate equal funds to last year’s top three Fidelity and top three Vanguard funds and hold them for a year.

- Fidelity 1st: at the end of each June, allocate all funds to last year’s top Fidelity fund and hold it for a year.

- Fidelity 2nd: at the end of each June, allocate all funds to last year’s second place Fidelity fund and hold it for a year.

- Vanguard 3rd: at the end of each June, allocate all funds to last year’s third place Vanguard fund and hold it for a year.

- EW Fidelity Top 3: at the end of each June, allocate equal funds to last year’s top three Fidelity funds and hold them for a year.

- Vanguard 2nd: at the end of each June, allocate all funds to last year’s second place Vanguard fund and hold it for a year.

- Fidelity 3rd: at the end of each June, allocate all funds to last year’s third place Fidelity fund and hold it for a year.

Statistics include (arithmetic) average annual return, standard deviation of annual returns, return/volatility and maximum (multi-year) drawdown. Findings include:

- The Vanguard set generally performs better than the Fidelity set.

- The drop-offs in performance from 1st to 2nd to 3rd are substantial among both Fidelity and Vanguard funds.

- The top Fidelity fund and the top Vanguard fund do not substantially diversify each other (the correlation of annual returns between Fidelity 1st and Vanguard 1st is 0.79).

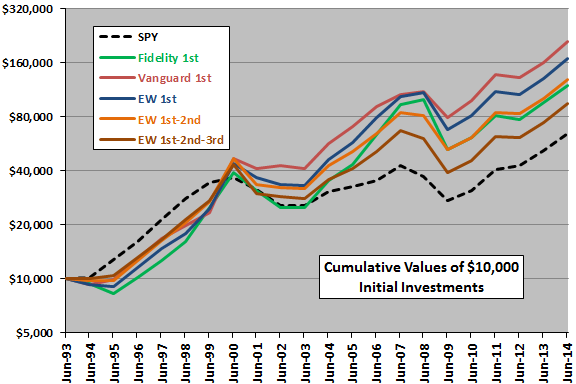

For another perspective, we look at cumulative performances of some of these portfolios.

The following chart compares on a logarithmic scale the cumulative values of $10,000 initial investments at the end of June 1993 in six of the above strategies. Results indicate that:

- All the “Hot Hand” mutual fund strategies underperform SPY for an extended subperiod in the 1990s, perhaps because mutual fund choices are limited during the subperiod. It is conceivable that introduction of SPY in itself promoted S&P 500 stocks.

- All the “Hot Hand” mutual fund strategies ultimately outperform SPY, with outperformance most evident in the last ten years, suggesting that a “Hot Hand” approach requires many equity mutual funds from which to choose.

- The trajectory for Vanguard 1st indicates that its volatility is largely upside volatility, such that diversification with other strategies increases maximum drawdown.

In summary, evidence from available data on the benefits of “Hot Hand” mutual fund diversification is mixed.

Cautions regarding findings include:

- As noted, there is an extended subperiod in the 1990s during which all “Hot Hand” strategies underperform SPY. This result indicates that investors would not have discovered and initiated any such strategy for most of the sample period.

- The sample period during which wide choices of specified funds are available is not long for evaluation of an annual strategy.

- Testing many different alternative strategies on similar data introduces snooping bias, such that the best-performing strategy incorporates luck. The fact that the best-performing strategy is the first one tested mitigates. The fact that prior research encouraged the first test indicates risk of secondary snooping bias and weakens mitigation.

- Two Vanguard funds are “ACQUIRED” between the date of “Mutual Fund Hot Hand Performance” and June 2014, emphasizing the possibility of survivorship bias from considering only currently available funds.