Do “new” momentum stocks outperform “old” ones? In the March 2012 version of their paper entitled “Limited Attention, Salience, and Stock Returns” [apparently removed from SSRN, casting doubt on findings], Avanidhar Subrahmanyam, Jason Wei and Hsin-Yi Yu analyze whether stocks newly entering and exiting extreme momentum deciles exhibit unusual future returns because of heightened investor attention. Their benchmark (6-6) strategy consists of conventional overlapping winner-minus-loser momentum portfolios that are long/short those stocks with the highest/lowest returns over the past six months, formed monthly (after a skip-month) and held for six months. They classify a stock as a 6-6 arriver if it is not in any of the five preceding overlapping winner-minus-loser portfolios and a 6-6 dropper if it was in at least one winner-minus-loser portfolio active during the previous five months but is not in any of the active portfolios this month. They also consider arriving and dropping stocks defined relative to ranking intervals of 3, 9 and 12 months and holding intervals of 1, 2, 3, 9 and 12 months. Within portfolios, they weight the winner and loser sides equally and each stock within the winner or loser side equally. Using daily and monthly prices and volumes for NYSE, AMEX and NASDAQ common stocks priced above $5, along with contemporaneous risk factor and robustness test data as available, during 1962 through 2010, they find that:

- 6-6 arrivers to both winners (decile 10) and losers (decile 1) perform very well the next month (over 3% return), but performance then quickly diminishes. The outperformance of new winners arriving from deciles 1, 2 and 3 is especially short-lived. New losers arriving from deciles 2, 3 and 4 outperform new winners, indicative of strong reversals.

- 6-6 droppers from both winners and losers generally perform poorly the next month, with mostly negative three-factor (market, size, book-to-market) alphas.

- The average number of monthly winners (losers) for the baseline 6-6 strategy is 822 (890), with about 21% or 169 (21% or 185) on the move each month.

- While not differing appreciably in size, arrivers and droppers tend to be relatively volatile. Arrivers have an average bid-ask spread of roughly 2.5% (close to the average for all stocks in the sample), while droppers have a relatively large average bid-ask spread of roughly 4.5%.

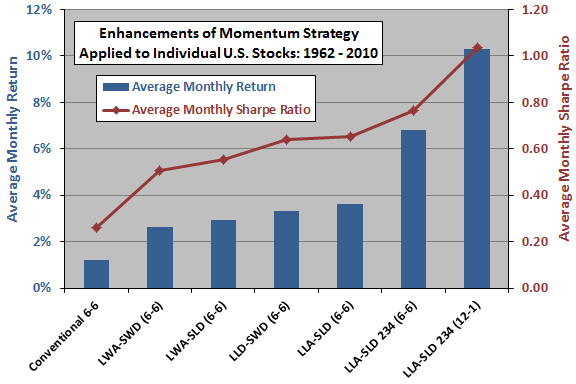

- Strategies that concentrate on the extreme returns of arrivers and droppers are much more profitable than conventional momentum strategies (see the chart below). For example, over the entire sample period, the average monthly gross return and Sharpe ratio for a portfolio that is each month long (short) 6-6 loser decile arrivers (6-6 loser decile droppers) are 3.6% and 0.65, respectively, compared to 1.2% and 0.26 for a conventional 6-6 momentum strategy.

- Further enhancement derives from focusing on loser arrivers from deciles 2, 3 and 4 and loser droppers to deciles 2, 3 and 4 (an average of 52 arrivers and 15 droppers per month). Over the entire sample period, the average monthly gross return and Sharpe ratio for a portfolio that is each month long (short) such a restricted portfolio of 6-6 loser decile arrivers (6-6 loser decile droppers) are 6.8% and 0.76, respectively. Defining arrivers and droppers relative to a 12-1 (rather than 6-6) baseline momentum strategy boosts average monthly gross return and Sharpe ratio to 10.3% and 1.03.

- Enhanced momentum strategy results are robust to:

- Dropping the skip-month between baseline strategy ranking and holding intervals. In fact, profitability is generally higher without the skip-month, as suggested by the rapidly fading returns of arrivers and droppers.

- Exclusion of January from calculations. While January returns are relatively strong for the enhanced strategies, performance in other months is very good.

- Different subperiods. In fact, there is steady improvement in enhanced strategy returns over time. During 2001-2010, the average monthly gross return and Sharpe ratio for a portfolio that is each month long (short) a portfolio of 12-1 loser decile arrivers from deciles 2, 3 and 4 (12-1 loser decile droppers to deciles 2, 3 and 4) are 16.4% and 1.05, respectively.

- Listing exchange and firm size, although NASDAQ stocks perform more impressively than NYSE/AMEX stocks.

- Based on available data, there is abnormally high short-term buying pressure for arrivers that reverses in the longer run, supporting the explanation that arrivers attract retail investor attention.

The following chart, constructed from data in the paper, summarizes monthly average gross returns and Sharpe ratios for momentum strategies focused on stocks newly arriving to or newly dropping from extreme past-return deciles. The baseline strategy and enhanced strategies are:

- Conventional 6-6: long winners and short losers (overlapping, with skip-month)

- LWA-SWD (6-6): long winner arrivers and short winner droppers (6-6 baseline)

- LWA-SLD (6-6): long winner arrivers and short loser droppers (6-6 baseline)

- LLD-SWD (6-6): long loser arrivers and short winner droppers (6-6 baseline)

- LLA-SLD (6-6): long loser arrivers and short loser droppers (6-6 baseline)

- LLA-SLD 234 (6-6): long loser arrivers and short loser droppers, from/to deciles 2, 3 or 4 only (6-6 baseline)

- LLA-SLD 234 (12-1): long loser arrivers and short loser droppers, from/to deciles 2, 3 or 4 only (12-1 baseline)

Results indicate that concentrating long positions on stocks newly arriving to the loser decile from nearby deciles and short positions on stocks newly departing from the loser decile to nearby deciles considerably improves momentum strategy performance.

In summary, evidence indicates that U.S. equity investors may be able to improve momentum strategy returns considerably by concentrating long (short) positions in stocks newly entering (exiting) the 10% of stocks with the worst past returns, with the entries and exits not deriving from violent short-term action.

Cautions regarding findings include:

- Reported returns and Sharpe ratios are gross, not net. Incorporating reasonable trading frictions, which tend to be relatively high for momentum strategies due to high turnover, would reduce them. Trading frictions (bid-ask spreads) may be exceptionally high for the short side of the best portfolios. Persistence into recent low-friction subsamples mitigates.

- Reported returns and Sharpe ratios also do not consider the feasibility and cost of shorting targeted stocks. Shorting limitations and costs would reduce profitability.

- The intricacy of definitions and the large number of combinations tested introduce data snooping bias, such that the best combinations may substantially overstate reasonable expectations for real trading.