What market conditions make stock price momentum strategies crash? In the October 2013 version of their paper entitled “Momentum Profits, Market Cycles, and Rebounds: Evidence from Germany”, Martin Bohl and Marc-Gregor Czaja analyze performance statistics for both price and earnings momentum portfolios of German stocks across different market states. They use a stock price momentum strategy that each month ranks stocks based on returns from 12 months ago to one month ago and then constructs a winner (loser) portfolio as the equally weighted top (bottom) fifth of past performers. They use an earnings momentum strategy that each month ranks stocks based on normalized analyst forecast revisions (earnings forecast revision ratio, or ERR) over the past month and then constructs a winner (loser) portfolio as the equally weighted highest (lowest) fifth of ERRs. Using the value-weighted total return CDAX as a proxy for the German stock market, they specify market state retrospectively as bull (bear) when it generally advances (declines) over six or more consecutive months without any interim new high. They focus on a market rebounds, defined as the first three months after a switch from bear to bull state with high market volatility. Using monthly data for a broad sample of German common stocks tracked by at least three analysts during February 1987 through October 2012 (an average of 171 stocks per month), they find that:

- Basic return statistics are:

- The price momentum winner (loser) portfolio generates a gross average monthly raw return of 1.10% (-0.47%), with gross long-short return therefore 1.57%.

- The earnings momentum winner (loser) portfolio generates a gross average monthly raw return of 1.08% (-0.42%), with gross long-short return therefore 1.49%.

- However, price momentum performance is nearly twice as volatile as that for earnings momentum.

- Gross three-factor (market, size, book-to-market ratio) alphas are a little lower than gross raw returns (1.25% and 1.33% per month for price and earnings momentum, respectively).

- During the three market rebounds in the sample (October-December 2001, April-June 2003 and March-May 2009), price momentum crashes:

- The price momentum winner (loser) portfolio generates a gross average monthly raw return of 4.37% (13.3%), with gross long-short return therefore -8.98%. The loser stocks tend to be very volatile, leveraged small-cap stocks that lose an average of nearly 83% of market value over the preceding year.

- During the 2003 and 2009 market rebounds, the long-short price momentum portfolio declines by -43.3% and -47.7%, respectively.

- By contrast, earnings momentum suffers only slightly during market rebounds.

- Earnings momentum to a large extent subsumes price momentum, but not vice versa.

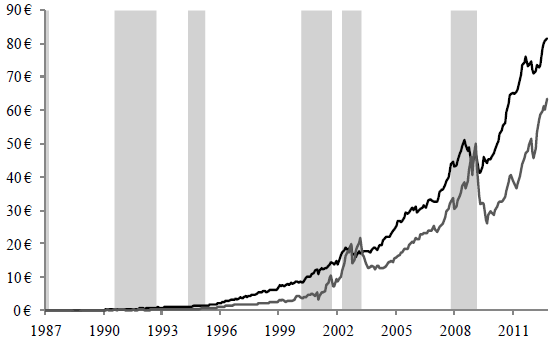

The following chart, taken from the paper, compares the gross cumulative values in euros of long-short momentum portfolios based on stock price momentum (gray line) and earnings momentum (black line) as specified above. Shaded areas indicate (retroactively determined) bear markets. Earnings momentum outperforms price momentum, which tends to crash during rebounds at the ends of bear markets.

In summary, evidence from German stocks indicates that a price momentum strategy crashes during rebounds immediately after bear markets due to strong recovery of past losers. In contrast, an earnings momentum strategy suffers only modest setbacks during market rebounds.

Cautions regarding findings include:

- Reported returns are gross, not net. Incorporating reasonable trading frictions, which tend to be relatively high for momentum strategies, would lower these returns.

- Accounting for stock borrowing cost/feasibility may eliminate any benefits of shorting loser stocks.

- As noted in the paper, retrospective identification of bull and bear market states generates findings that are not fully exploitable. An investor operating in real time cannot reliably identify market bull and bear states, and market rebound phases, until some of the state/phase is past.

- Selection of parameters defining momentum and market states may involve data snooping, such that findings overstate out-of-sample expectations.

- The sample is not large in terms of number of market rebounds as specified.