Do hedge funds trade on market risk, idiosyncratic risk or tail risk? In their November 2011 paper entitled “Systematic Risk and the Cross-Section of Hedge Fund Returns”, Turan Bali, Stephen Brown and Mustafa Caglayan explore the predictability of hedge fund returns based on distinct market-related (systematic), idiosyncratic (residual) and tail risk measures. They alternatively consider four-factor (equity market, size, book-to-market and momentum), six-factor (adding two bond factors) and nine-factor (adding currency, bond and commodity momentum) models of market risk. They employ both three-year rolling regressions and equally weighted quintile portfolios formed from monthly sorts to relate hedge fund risks and returns. They ignore funds with less than 24 months history and avoid a measured 1.87% annual backfill bias (only funds with good first years volunteer performance) by ignoring the first 12 months of returns for each fund. Using monthly net returns and characteristics for a sample of 14,228 hedge funds (8,201 dead and 6,027 live) during January 1994 through June 2010, they find that:

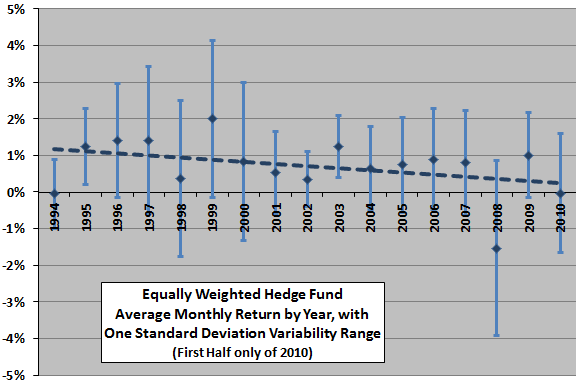

- Average hedge fund performance varies considerably over time, with 2008 a remarkably bad year (see the chart below).

- Ignoring dead funds would introduce an average annual survivorship bias of 1.91%.

- Median fund age is only 51 months, suggesting that managers close funds after losses rather than trying to recover, perhaps because they face years of no fees tied to high water marks.

- While average fund size is $127 million, median size is only $29 million.

- Both regressions and sorted portfolios indicate a significantly positive relationship between fund total risk (past return distribution variance) and future returns.

- The systematic component of total risk dominates the residual component in explaining future hedge fund returns.

- Across all funds, average future return decreases regularly across quintiles sorted on systematic risk, and the fifth of funds with the highest systematic risk beats the fifth with the lowest by an average 6% per year.

- Systematic risk retains significant predictive power for future returns after controlling for fund age, size, management fee, incentive fee, redemption period, minimum investment amount, lockup and leverage structure, while the relationship between residual risk and future returns remains insignificant.

- The power of systematic risk to predict future returns increases with hedge fund style directionality, such that the average monthly return difference between the highest and lowest systematic risk quintiles produces an average monthly return of:

- Approximately zero for Equity Market Neutral, Fixed Income Arbitrage and Convertible Arbitrage.

- 0.27% to 0.70% for the semi-directional Fund-of-Funds, Multi-Strategy, Long-Short Equity Hedge and Event Driven.

- 0.72% to 1.09% for the directional Managed Futures, Global Macro and Emerging Markets.

- There is no relationship between past return distribution tail risk (skewness and kurtosis) and future returns.

The following chart, constructed from data in the paper, summarizes the equally weighted average monthly hedge fund returns and the dispersion of these returns across funds by calendar year over the sample period. The chart also shows a linear trend line, indicating a decline in average returns over time. A linear trend line based on median, rather than average, monthly raw returns is nearly identical.

The Pearson correlation between average/median fund returns and same-interval SPDR S&P 500 (SPY) returns over this period is about 0.75. Removing 2008 drops this correlation to around 0.60.

In summary, evidence indicates that hedge funds with high total and market-related past return variability tend to outperform those with low variability over the near term.

Cautions regarding findings include:

- Hedge funds generally do not allow entry/exit on a monthly basis, severely limiting exploitability of findings.

- See “Characteristics of Persistently Outperforming Hedge Funds” for ostensibly different conclusions regarding determinants of long-term hedge fund performance.