Do multi-class mutual funds exhibit good asset class allocation timing? In their April 2015 paper entitled “Multi-Asset Class Mutual Funds: Can They Time the Market? Evidence from the US, UK and Canada”, Andrew Clare, Niall O’Sullivan, Meadhbh Sherman and Steve Thomas investigate whether mutual fund managers time allocations across asset classes skillfully. They focus on three asset classes: equities, government bonds and corporate bonds. They apply two alternative methodologies: (1) returns-based, relating each asset class beta for a fund to next-month return for that class; and, (2) holdings-based, relating changes in asset class weights within a fund to next-month class returns. Using monthly returns and holdings for 617 U.S., UK and Canadian multi-asset class mutual funds during 2000 through 2012, they find that:

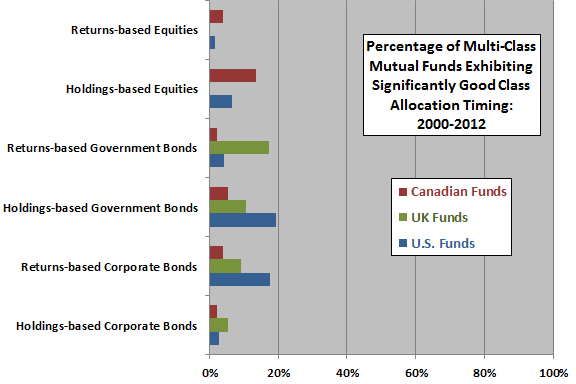

- The percentage of mutual funds exhibiting significantly good asset class timing is less than (mostly much less than) 20% for any method/class/country combination (see the chart below).

- Average percentages of funds exhibiting significantly good timing by country are about 9%, 7% and 5% for the U.S., UK and Canada, respectively.

- Average percentages of funds exhibiting significantly good timing by asset class are about 7%, 10% and 4% for equities, government bonds and corporate bonds, respectively.

The following chart, constructed from data in the paper, summarizes percentages of multi-class mutual funds exhibiting significantly good asset class timing by evaluation method, asset class and country over the entire sample period. The average percentage across all categories is about 7%.

In summary, evidence indicates that only a small percentage of multi-class mutual funds exhibit significantly good asset class timing.

Cautions regarding findings include:

- The sample period is short and may not be representative of long-term financial market conditions.

- The study does not investigate ways of identifying which funds are likely to exhibit good asset class timing in the future (persistence).

- Statistical methods assume tame return distributions and linear relationships. To the extent these assumptions are incorrect, these methods break down.