How should investors view illiquid assets? In the January 2013 draft of his book chapter titled “Illiquid Asset Investing”, Andrew Ang summarizes the characteristics of investments in illiquid assets. Illiquid investments typically exhibit infrequent trading, small trades (in terms of number of units) and low turnover. Examples are hedge funds (to some degree), real estate and aesthetic investments such as art and jewels. He does not address the largest illiquid component of an individual’s wealth, human capital. Based on available research, he concludes that:

- Typical holding periods for single-family homes, commercial properties and works of art are 4-5 years, 8-11 years and 40-70 years, respectively.

- For many individuals, 90% of their total wealth is in an illiquid asset, their home.

- High-net worth individuals in the U.S. (other countries) allocate roughly 10% (20%) of their portfolios to illiquid “treasures” like fine art and jewelry.

- Investors should be skeptical of returns reported for illiquid assets due to survivorship bias, infrequent trading (very small samples) and selection bias (tendency to sell only when prices are high). After taking these biases into account, it is unlikely that illiquid asset classes generate higher risk-adjusted returns than stocks and bonds.

- However, there are significant illiquidity premiums within asset classes, such that less liquid items tend to outperform more liquid similar items.

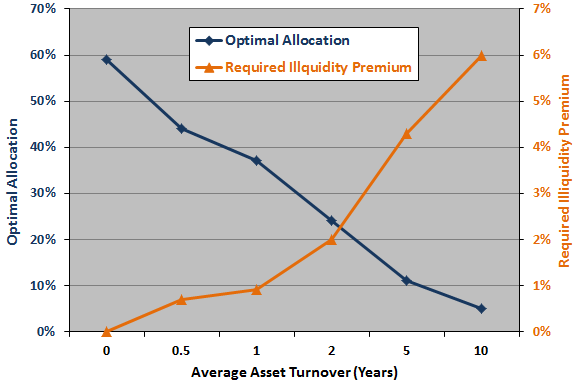

- Portfolio models incorporating illiquidity risk indicate modest holdings and high premiums for highly illiquid assets (see the chart below). For example, an asset with an average trading interval of 10 years has an optimal allocation of only 5% and should command an illiquidity return premium of about 6%.

The following chart, constructed from data in the draft chapter, summarizes optimal allocations and required illiquidity annual return premiums according to turnover, as derived from portfolio models that address asset illiquidity. In general, allocation decreases and required illiquidity increase as typical holding period increases.

In summary, research on illiquid assets suggests that investors should make relatively small allocations to them and require high return premiums from them.

Cautions regarding conclusions include:

- Models of optimal allocations and required premiums for illiquid assets involve arguable assumptions and are difficult to test.

- The draft chapter does not address diversification benefits of illiquid asset classes (correlations with conventional classes).