What approach to diversifying equity holdings across industries and global geographies is most sensible? In the October 2010 version of his paper entitled “Assessing Alternative Global Equity Investment Frameworks”, Xi Li compares the feasibility and optimality of eight possible approaches for grouping of stocks by geography and industry/sector. He compares feasibility of diversification grouping approaches based on a requirement that each group has at least 15 stocks, such that groups exhibit reasonably reliable behavior. He compares optimality of diversification grouping approaches based on ability to explain the variation in returns across groups (effectiveness in grouping similar stocks). Using monthly returns for mostly large and medium capitalization stocks of 23 developed country markets assigned to three regions (Americas, Asia Pacific and Europe), 10 sectors and 24 industries over the period July 1989 through March 2010 fewer, he finds that:

- Tests of diversification approach feasibilityover the entire sample period and a 2000-2010 subperiod indicate that:

- Groupings by region, country, sector and industry separately, and by region-sector and region-industry combinations, produce few groups smaller than 15 stocks and are thus feasible.

- Groupings by country-sector and country-industry produce many groups smaller than 15 stocks and are thus infeasible.

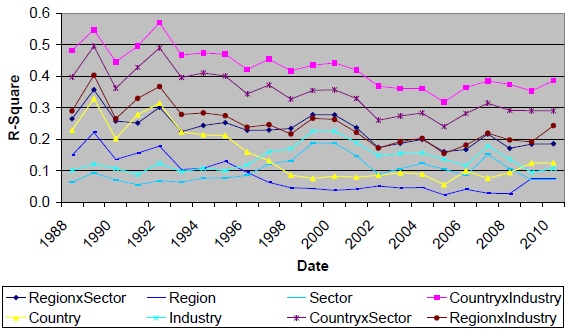

- Tests of diversification approach optimality over the entire sample period and two equal subperiods, as measured by R-squaredstatistics for variation of returns across groups (see the chart below), indicate that:

- Groupings by country-sector and country-industry combinations are consistently most effective in grouping similar stocks (but are, as stated above, infeasible).

- Among feasible approaches, the region-industry combination is most effective in grouping similar stocks, and the region-sector combination is second most effective.

- Effectiveness of industry/sector (geography) in grouping similar stocks increases (decreases) over time, such that industry/sector diversification has been more important than geographical diversification in recent years.

The following chart, taken from the paper, summarizes results of optimality calculations by year for the eight diversification approaches considered in the study. The optimality metric is an R-squared statistic that explains the ability of a diversification approach to explain the differences in returns among the stock groupings it produces. A high R-squared indicates that the approach effectively groups similar stocks (and the groups should therefore effectively diversify each other).

While the country-sector (CountryxSector) and country-industry (CountryxIndustry) combinations are most effective in grouping similar stocks, the resulting groups are frequently too small for reliable implementation. The region-sector (RegionxSector) and region-industry (RegionxIndustry) combinations offer the best compromise of grouping effectiveness and group size.

Note the general increase (decrease) in the effectiveness of industry and sector (country and region) diversification approaches in grouping similar stocks over time.

In summary, evidence from feasibility and optimality tests over the past two decades suggest that region-sector and region-industry combinations are the best approaches for global equity diversification.

Note that the study targets institutional investors. Inclusion of stocks with smaller market capitalizations may alter findings.