How should investors choose among alternative tactical asset allocation strategies? In their January 2013 paper entitled “Rethinking the Asset Allocation Approach for Plan Sponsors”, Pranay Gupta and Sven Skallsjo present a multi-strategy tactical asset allocation framework for very large (institutional) investors. They assume that the strategic asset allocation (portfolio policy) is to maximize capital appreciation with “the highest efficiency” and 90% confidence that annual drawdown will not exceed 10%. In developing their allocation framework development, they consider recent statistics describing the performance and interaction of eight asset class indexes, each able to absorb large investments/rebalancing actions (four global regional equities, global government bonds, global corporate bonds, global high-yield bonds and gold). Using illustrations based on monthly asset class index returns during September 2000 through September 2012, they conclude that:

- All equity indexes and high-yield bonds have large annual drawdowns and high pairwise return correlations, and government and corporate bonds have a high return correlation. In fact, the essential stocks-bonds diversification decision devolves to equity risk and credit risk. The potential for simple diversification is therefore limited.

- Capacity constraints of low-correlation (alpha) strategies such as equity-neutral, event-driven and relative value hedge funds prevent them from serving as a complete solution.

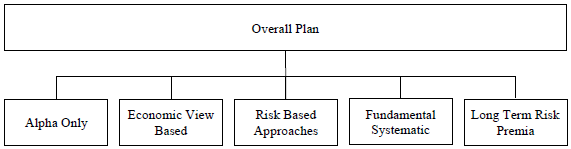

- However, additional diversification can come from including different decision-making processes applied to the same asset classes, each process exploiting distinct information sources, investment horizons and rebalancing frequencies (see the figure below).

The following figure, taken from the paper, is a multi-strategy diversification framework involving five distinct strategy categories:

- Alpha Only (hedge fund-like) strategies generally have low correlations with other asset classes and often exhibit low volatility.

- Economic View Based strategies rely on subjective assessments of the current economic environment (“common sense”).

- Risk Based Approaches (such as risk parity) disregard expected returns and focus entirely on the risk side to suppress outcome volatility.

- Fundamental Systematic strategies include: (1) thematic approaches exploiting asset class characteristics expected to carry a premium (such as size, value or earnings-price ratio); and, (2) mechanical rules based on economic fundamentals such as GDP growth rate.

- Long Term Risk Premia strategies rely on estimates of risk and reward over a long historical time period (50 – 100 years).

Weighting of strategy categories could be equal, performance-based or conviction-based. An example applied to the asset classes considered above using equal weighting of the five strategy categories generates monthly returns about the average of the five categories with very low volatility and relatively low maximum drawdown.

In summary, diversifying across both asset classes and tactical asset allocation strategies may produce attractive risk-adjusted performance.

Cautions regarding conclusions include:

- The paper uses indexes rather than tradable assets, thus ignoring the costs of creating and maintaining tradable assets (which may differ by asset class and therefore affect allocation decisions).

- As noted in the paper, the example of diversifying across tactical allocation strategies involves very rough assumptions and a sample period too short for reliable inference.

- Investors not constrained by massive portfolios may have access to additional asset classes and the latitude to concentrate in alpha strategies (but may not have access to hedge funds).

- Technical trading strategies could be considered under the “Alpha Only” category.