Should investors consider a broader framework to encompass trend-following/momentum investing strategies? In his March 2013 paper entitled “Asset Price Trend Theory: Reframing Portfolio Theory from the Ground Up”, Robert Dubois presents a portfolio allocation strategy that explicitly includes an assumption that asset prices trend (exhibit return autocorrelation or intrinsic momentum). His approach augments risk management by including stop-loss protocols to exit allocations to some assets/strategies based on their trends relative to specified thresholds. He defines three strategic allocation segments: (RB1) risk-free assets; (RB2) liquid risky assets/strategies subject to stop-loss exits at the asset and/or portfolio level; and, (RB3) both liquid and illiquid risky assets not subject to stop-loss exits. All three segments are subject to asset/strategy selection, position sizing and entry rules. RB2 arguably allows strong risk management (containment) via trend-related removal of exposure to risky assets with below-trend performance. Elaborating on this framework, he concludes that:

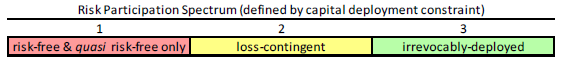

- A first step is to allocate funds across RB1, RB2 and RB3 (see the figure below), potentially including a minimum value for RB1 as a definitive total portfolio value floor and a rebalancing discipline.

- Shifting weight from RB3 to RB2 (and perhaps RB1) increases emphasis on risk containment.

- The investor may be able to exploit strong emphasis on risk containment by selecting aggressive assets/strategies and stop-loss exits for RB2.

- Investors choosing not to emphasize risk containment via large allocations to RB2 can moderate risk by selecting conservative assets/strategies for RB3.

- Focus then shifts to selection of component assets/strategies to populate RB2 and RB3.

The following figure, taken from the paper, depicts simply the three proposed strategic allocation segments:

- RB1: risk-quarantined, consisting of assets such as short-term U.S. Treasuries, money market funds and certificates of deposit up to insured limits.

- RB2: capital at risk subject to stop-loss risk containment designed to exploit predictable price trending, such as exchange-traded assets or strategies built from such assets.

- RB3: capital irrevocably deployed and fully at risk (buy and hold), potentially including liquid assets and especially relatively illiquid assets such as real estate, art and collectibles and locked-up hedge funds and private equity.

In summary, investors may want to consider a three-segment portfolio, with one segment focused on active risk management based on belief in the exploitability of asset price trends.

Cautions regarding conclusions include:

- The arguments in the paper are qualitative, not mathematically specified or derived.

- The paper does not examine empirical outcomes associated with the proposed allocation framework.