What is the most important aspect of long-term investing? In the July 2012 version of his paper entitled “Strategic Asset Allocation and Portfolio Performance”, Lujer Santacruz assesses the importance of strategic asset class allocation compared to other sources of returns for a set of Australian managed funds. He specifies three fund return components as: (1) strategic allocation, derived from asset class benchmark returns weighted according to stated fund targets; (2) timing, derived from the difference between actual and target fund asset class weights; and, (3) security selection, derived from the difference between actual and benchmark asset class returns. Using actual quarterly total returns, target asset class allocations and actual asset class allocations for Vanguard’s four diversified Australian funds (Conservative, Balanced, Growth and High Growth), along with quarterly returns for six relevant benchmark indexes, during January 2003 through June 2012, he finds that:

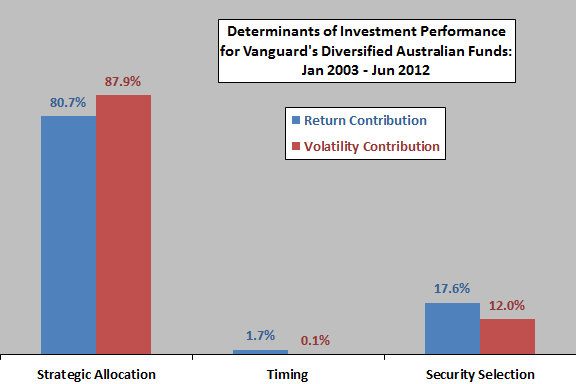

- Strategic allocation accounts for (see the chart below):

- 81% of total fund returns.

- 88% of fund return variability

- Timing contributes essentially nothing to returns.

- The importance of strategic allocation generally increases with portfolio riskiness, especially for return variability, accounting for 70% (98%) of return variability of the Conservative (High Growth) fund.

The following chart, constructed from data in the paper, summarizes the aggregate value-weighted contributions to return and return variability for the set of four managed funds by the three determinants of performance: strategic allocation, timing and security selection. Results show that strategic asset class allocation targets account for more than four fifths of fund performance, while market timing is of little or no importance.

In summary, evidence indicates that strategic asset allocation (setting of persistent asset class targeting) is by far the most important decision for long-term investors.

Cautions regarding findings include:

- The sample is not long, consisting of two bull and one bear markets for equities (42 quarters).

- Lack of a timing contribution may derive from a management policy eschewing market timing, rather than failure to time.