Are publicly traded Master Limited Partnerships attractive investments? In their June 2014 paper entitled “Master Limited Partnerships (MLPs)”, Frank Benham, Steven Hartt, Chris Tehranian and Edmund Walsh describe and summarize the aggregate performance and characteristics of publicly traded MLPs. These partnerships are predominantly owners of “toll road” energy infrastructure, U.S. oil and natural gas pipelines and resource shipping. Like real estate investment trusts (REIT), MLPs are pass-through entities for tax purposes. Their distributions to partners are not subject to double-taxation as are corporate dividends. Unlike REITs, MLPs may retain income to fund growth. The general (managing) partner of an MLP typically earns an incentive-based share of distributions larger than that of limited (passive) partners. MLPs involve tax, accounting and administrative complications associated with partnerships. Using monthly returns for the capitalization-weighted Alerian MLP Index and for other asset class indexes during January 2000 through April 2014, they conclude that:

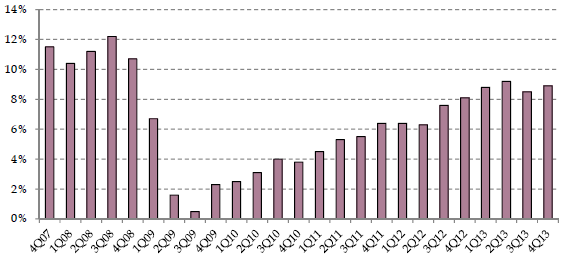

- MLPs generally offer attractive current yields and increases in distributions that reflect growth in their energy infrastructure holdings in recent years (see the chart below). Demand for future U.S. energy infrastructure (especially natural gas pipelines) indicates further growth.

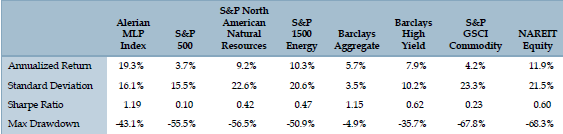

- Over the entire sample period, MLPs perform well compared to common stocks, energy sector stocks, bonds, commodities and REITs. Specifically, since 2000 (see the table below) the Alerian MLP Index:

- Generates an annualized return of 19.3% and an annual Sharpe ratio of 1.19.

- Has negative returns in only two of 14 calendar years.

- Outperforms the S&P 500 Index in 11 of 14 calendar years.

- Exhibits volatility and drawdowns similar to equities and higher than bonds (but lower than commodities and REITs).

- MLP returns have relatively low correlations with those of stocks and commodities. Specifically, the correlation of monthly returns between the Alerian MLP Index and:

- The S&P 500 Index is 0.40 (compared to 0.63 between the S&P 500 Index and REITs).

- The S&P GSCI Index is only 0.30.

- Based on available data, MLPs produce stronger (weaker) returns when the inflation rate is relatively low (high), but data is not available for periods of very high inflation. MLPs appear not to hedge inflation as well as commodities and natural resource stocks.

- With respect to MLP valuation as of April 2014:

- The relatively low yield of the Alerian MLP Index implies that future returns may be smaller than past returns.

- The spread between the Alerian MLP Index yield and the 10-year U.S. Treasury note yield is slightly below its historical average, suggesting modest overvaluation of MLPs.

- There is an administrative burden associated with holding MLPs directly as a limited partner, and tax-exempt organizations may incur tax liabilities (from Unrelated Business Taxable Income).

- Exchange-traded funds (ETF) that hold MLPs offer diversification, liquidity and simplified tax reporting, but sacrifice the tax efficiency of direct ownership of MLPs.

The following chart, taken from the paper, shows the year-over-year growth in aggregate MLP distributions by quarter from the fourth quarter of 2007 through the fourth quarter of 2013. Results indicate persistent, but not uniform, growth.

The following table, also from the paper, summarizes annualized returns, standard deviations of annual returns, annual Sharpe ratios and maximum drawdowns for the Alerian MLP Index and equity energy sector, aggregate bond, high-yield bond, commodity and REIT indexes during January 2000 through April 2014. The performance of MLPs is relatively strong but subject to substantial volatility and drawdowns.

In summary, evidence indicates that MLPs may be attractive standalone investments and good diversifiers of portfolios holding common stocks, bonds, commodities and REITs.

Cautions regarding conclusions include:

- Index returns do not account for trading frictions incurred by entering and rebalancing positions.

- MLP funds involve management and administrative fees and, as noted in the paper, must maintain some cash reserves for taxes.

- As described in the paper, investors may find direct holdings in MLPs as limited partners administratively burdensome.

See also “Simple Tests of AMJ as Diversifier”.