Where is the price of gold headed? In their August 2015 paper entitled “The Golden Constant”, Claude Erb and Campbell Harvey apply a “golden constant” hypothesis (inflation is the principal driver of the price of gold) to project the future price of gold. Specifically, they explore implications of mean reversion of the real price of gold. Using the monthly relationship between gold price in U.S. dollars and U.S. inflation during 1975 through the first half of 2015, they find that:

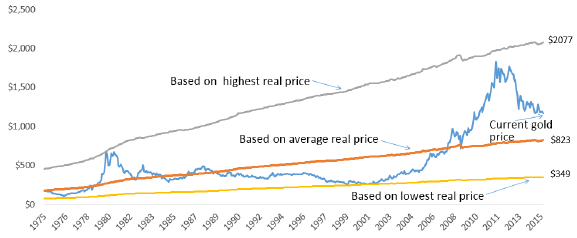

- As of July 2015 (see the chart below):

- The fair value of gold is $823 per ounce.

- Historical extreme overshoots (undershoots) of fair value suggest a possible high (low) gold price of $2,077 ($349) an ounce.

- Assuming 2% annual inflation for the next 10 years, the fair value of gold increases from $823 to $1,006 per ounce.

- A return to fair value over the next 10 years implies a real annualized return for gold of -2.8%. The extreme undershoot scenario implies an real annualized return of -10.8%.

- While gold might protect against inflation over the very long run, 10 years is not a long run. In the short run, gold price is volatile and likely to overshoot or undershoot any notion of fair value.

The following chart, taken from the paper, shows the expected range of the nominal price of gold based on in-sample highest, average and lowest real price over the sample period. Results suggest that: (1) gold has a very wide range of possible prices; and, (2) gold may be undervalued or overvalued for long periods.

In summary, the “golden constant” hypothesis suggests a fair value gold price gold of $823 per ounce, with a plausible range of $349 to $2077.

Cautions regarding conclusions include:

- The historical perspective is in-sample. An investor operating in real time would have observed an evolving average real price sometimes very different from the current average. This in-sample approach is not useful for backtesting strategies to exploit deviation of gold price from fair value.

- Large and persistent deviations of gold price from the average real price undermine belief in the “golden constant” hypothesis. As noted in the paper, “it is possible to enthusiastically believe in other hypotheses.”

See also “Future of the Price of Gold”, which summarizes underlying analyses, and “Gold Price and U.S. Interest Rates”.