Does the Capital Asset Pricing Model (CAPM) make predictions useful to investors? In his October 2014 paper entitled “CAPM: an Absurd Model”, Pablo Fernandez argues that the assumptions and predictions of CAPM have no basis in the real world. A key implication of CAPM for investors is that an asset’s expected return relates positively to its expected beta (regression coefficient relative to the expected market risk premium). Based on a survey of related research, he concludes that:

- The seminal research of Fama and French finds that the correlation between returns and betas of U.S. stocks is very small during 1963-1990.

- Estimating stock betas using historical data is problematic because results can be unstable over even short periods and depend materially on:

- The stock index used to calculate market returns.

- The historical interval (one year, three years, five years…) used in the regression to derive betas.

- The sampling frequency (daily, monthly, yearly,…) used to calculate stock and market returns.

- Accordingly, there are large differences among beta data providers, as found in a recent survey of 16 websites and databases for the beta ranges of Coca Cola (0.31 to 0.80), Walt Disney (0.72 to 1.39) and Wal-Mart (0.13 to 0.71).

- Industry-level betas are also unstable. On average across industries, maximum estimated beta is 2.7 times minimum beta.

- The relative magnitude of betas often makes little sense. Estimated betas of arguably high-risk firms are often lower than those of arguably low-risk firms, suggesting that each investor should apply common sense and good judgment about a company, its industry and its national economy to estimate its riskiness (see the example below).

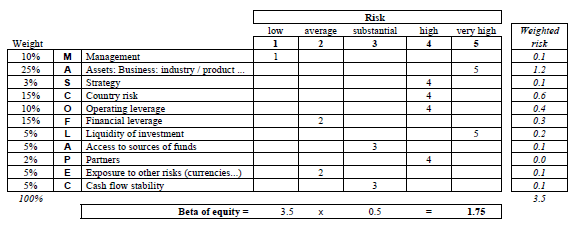

The following table, taken from the paper, illustrates one way to construct a “common sense beta” that considers and weights a menu of 11 firm risks on a five-point judgmental scale to construct a qualitative “beta” that summarizes stock riskiness. The five-point scale and final 0.5 multiplier are arbitrary, such that resulting “betas” are useful only for comparison of stocks.

In summary, evidence from the body of research indicates that CAPM beta is not a useful tool for investors.

Cautions regarding conclusions include:

- The paper offers no analysis relating qualitative “betas” to future stock returns. These “betas” may be no more useful in predicting stock returns than CAPM betas.

- Snooping of choices available (market proxy, beta calculation interval, sampling frequency) in estimating stock betas and the expected market return may produce evidence in support of CAPM.