Can speculators in agricultural commodity futures earn a reliable premium from those seeking to hedge agricultural industry risk? In other words, can traders systematically exploit a persistent backwardation of agricultural commodity futures contracts? In the May 2011 version of their paper entitled “Returns to Traders and Existences of a Risk Premium of a Risk Premium in Agricultural Futures Markets”, Nicole Aulerich, Scott Irwin and Philip Garcia investigate whether hedgers pay speculators for protection against adverse price movements in 12 agricultural commodity futures markets (cocoa, coffee, corn, cotton, feeder cattle, lean hogs, live cattle, soybeans, soybean oil, sugar, CBOT wheat and KS wheat). They focus on the performance of commodity index traders (emerging in 2004), who should expose this risk premium by passively holding positions opposite of hedgers. Using end-of-day prices and positions data for 12 agricultural commodity futures contracts and options by type of trader (commercial hedger, large speculators, commodity index trader and small traders) during January 2000 through September 2009 (a period of large price changes), they find that:

- The numbers of unique traders are 10,470 large speculators, 3,975 commercial hedgers and only 42 commodity index traders.

- Over the sample period, eight of the 12 agricultural commodities experience price increases over 50%, and only one (lean hogs) has a price decrease.

- In aggregate over the sample period:

- Commercial hedgers grow increasingly net short, losing a total of $698 million with losses in five of 12 markets. About 50% of hedgers show a profit.

- Large speculators fluctuate between net long and net short, earning a total profit of $7.9 billion with gains in nine of 12 markets, consistent with a belief that they are skilled. About 50% of speculators show a profit.

- Commodity index traders offset commercial traders by growing increasingly net long, losing a total of $6.9 billion with losses in nine of 12 markets. About 40% of index traders show a profit.

- Small traders lose $366 million, consistent with a belief that they are unskilled.

- While their losses are higher during a contract roll interval at the beginning of the month prior to contract expiration, commodity index traders also lose money outside this interval.

- Most of the loss for commodity index traders may derive from paying other traders for liquidity.

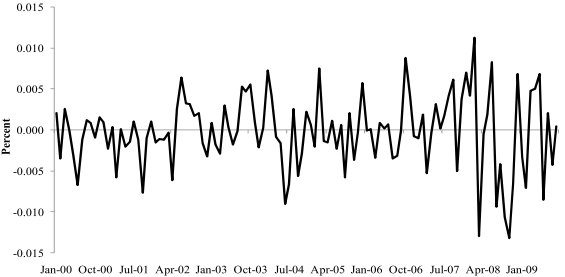

The following chart, taken from the paper, plots commodity index trader monthly profitability aggregated across traders and commodities over the sample period. The average monthly return on investment is -0.0002%, indicating no risk premium from transfer of risk from hedgers.

In summary, evidence supports a belief that large agricultural commodity futures speculators earn profits by successful market timing, not by systematically extracting a risk premium from hedgers.

Cautions regarding findings, as noted in the paper, include:

- Profit calculations are gross, not net. Accounting for trading frictions would reduce profits/increase losses.

- Commodity index traders are not completely passive, exhibiting a slight tendency for momentum trading.