How has recent data meshed with seminal research on commodity futures? In the June 2012 version of their paper entitled “Commodity Investing”, Geert Rouwenhorst and Ke Tang review and update research relevant to investing in commodity futures, with trader positions recorded via Commitments of Traders (COT) reports issued by the Commodity Futures Trading Commission monthly during 1986 through 1992, weekly since 1993 and more granularly since 2006. They assume commercial traders are hedging physical commodities and non-commercial traders are speculators. Using monthly prices and and trader positions for 28 commodity futures contract series during 1986 through 2010, they find that:

- Support for the Theory of Normal Backwardation (futures prices tend to be below expected future spot prices due to shorting by hedgers) is weak:

- Commercial hedgers are on average net short in 25 out of 28 markets, indicating some downward hedging pressure on futures prices, but their average position across all commodities is only 12.6% net short.

- Only two of 28 commodity futures exhibit statistically significant gross risk premiums (contract roll returns). However, an equally weighted commodity futures index generates an average gross annual risk premium of 3.4%.

- Based on recent COT data, speculators do not reliably earn positive gross returns by simply trading against commercial hedgers. Nor do variations in hedging pressure predict gross commodity futures returns.

- Evidence is more consistent with the Theory of Storage (futures prices exceed current spot prices by the cost of storage minus a convenience yield).

- Recent COT data indicate that:

- Speculators generally trade on momentum, while commercial hedgers tend to contrarian trading. Data available since 2006 indicates that money managers account for most of the momentum trading among speculators.

- Changes in aggregate speculative positions do not predict gross commodity futures returns.

- Data available since 2006 indicates that changes in aggregate positions of commodity futures index traders do not predict gross commodity futures returns.

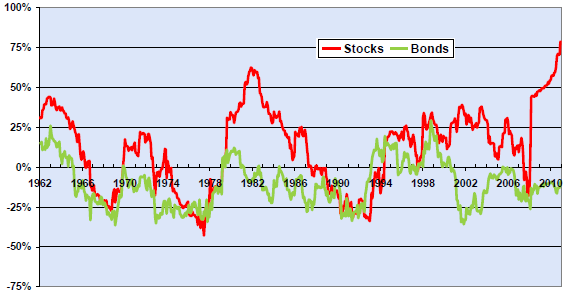

- Recent data suggests that index trading may be increasing return correlations between the commodity futures and stock markets (see the chart below).

The following chart, taken from the paper, shows rolling 36-month correlations of monthly returns between an equally-weighted commodity futures index and the S&P 500 Index (Stocks) and between the commodity futures index and long-term U.S. Treasury bonds (Bonds) during January 1962 through August 2011. Results suggest that recent growth in commodity futures index investing may be driving the commodities-stocks correlation upward.

In summary, evidence from 1986-2010 return and trader position data for commodity futures indicates: (1) minimal risk premiums (with an index premium most attractive); (2) little or no return predictability; and, (3) a currently high correlation between stock market and commodity futures market returns.

Cautions regarding findings include:

- Calculations of commodity futures returns are gross, not net. Trading frictions would impede exploitation.

- As noted in the paper, commodity futures research is generally thin compared to that for stocks and bonds.