Do changes in the level of futures markets activity predict returns for corresponding asset classes? In their January 2011 paper entitled “What Does Futures Market Interest Tell Us about the Macroeconomy and Asset Prices?”, Harrison Hong and Motohiro Yogo relate futures markets open interest (the number of contracts outstanding) to future asset class returns. They focus on the 12-month change in open interest and 12-month future return. As noted by the authors, simple logic suggests that open interest should be a non-directional because each futures contract involves countering long and short positions. However, changes in the number of futures contracts could indicate changes in anticipated economic risks. Using monthly open interest data for 30 commodity futures, eight currency futures, ten bond futures, 14 stock index futures and corresponding asset class returns for periods from earliest availability of data through 2008, they find that:

- In general, changes in open interest significantly forecast commodity, currency, bond and stock market gross returns.

- Rising commodity futures open interest predicts rising commodity prices, falling bond prices and rising short-term interest rates.

- A one standard deviation increase in commodity futures open interest, indicating economic expansion and rising inflation, cuts expected gross monthly bond return by 0.32%.

- A one standard deviation increase in commodity futures open interest boosts expected gross monthly commodity return by 0.63%.

- Rising currency futures open interest predicts rising exchange rates for foreign currencies relative to the U.S. dollar. A one standard deviation increase in currency futures open interest boosts expected gross monthly currency return by 0.35%. Currency futures open interest is a better predictor of exchange rates than the forward discount.

- Rising in bond futures open interest predicts falling bond prices. A one standard deviation increase in bond futures open interest cuts expected gross monthly bond return by 0.31%.

- Rising stock index futures open interest predicts rising stock prices. A one standard deviation increase in stock index futures open interest boosts expected gross monthly stock market return by 0.38%. This relationship, however, is not statistically significant.

- In general, futures open interest remains a strong predictor of associated asset class gross returns even after controlling for other widely used return predictors such as short-term interest rate, yield spread, past returns, ratio of futures price to spot price and net futures position of hedgers.

- A plausible explanation of these relationships is that informed hedgers are more active in anticipation of economic expansion and rising inflation.

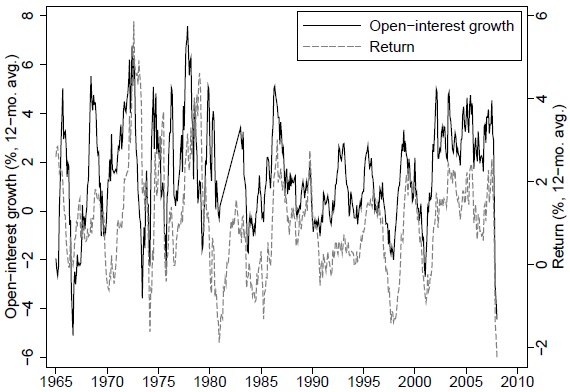

The following chart, taken from the paper, compares the 12-month geometric mean growth rate of commodity futures open interest and the 12-month geometric mean gross returns for a portfolio of fully collateralized commodity futures, equally weighted across agriculture, livestock, energy and metals during December 1965 through December 2008. The chart shows that open interest growth rate leads return by a few months.

The paper presents similar charts for currencies, bonds and stock indexes.

In summary, evidence indicates that changes in open interest in futures markets are strong predictors of returns for associated asset classes, even after controlling for a number of conventional predictors. Investors may be able to exploit these predictive powers via tactical asset class allocation.

However, the study does not explicitly translate this evidence into a realistic trading strategy.