Has the strong appreciation of gold since 2001 produced a price bubble? In their March 2011 paper entitled “Is There a Speculative Bubble in the Price of Gold?”, Jedrzej Bialkowski, Martin Bohl, Patrick Stephan and Tomasz Wisniewski measure deviations of actual gold price from its fundamental value to identify gold bubbles. They use the convenience yield model and associated monthly commodity “dividends” (benefit of holding gold rather than gold futures) to derive gold’s fundamental value. They then apply a regime-switching test to estimate whether deviations of actual gold price from fundamental value enter bubble territory over their sample period. Using daily gold spot and nearby futures contract prices and the Treasury bill yield (risk-free rate) during November 1978 through March 2010 (377 months), they find that:

- The logarithm of the commodity “dividend” for gold relates positively to log gold price, explaining more than half of both its real and nominal variations over the entire sample period.

- The regime switching test indicates that the commodity “dividend” supports the gold price over the sample period, with no evidence of speculative bubbles during the 1979-1982 gold price boom or at the end of the sample period.

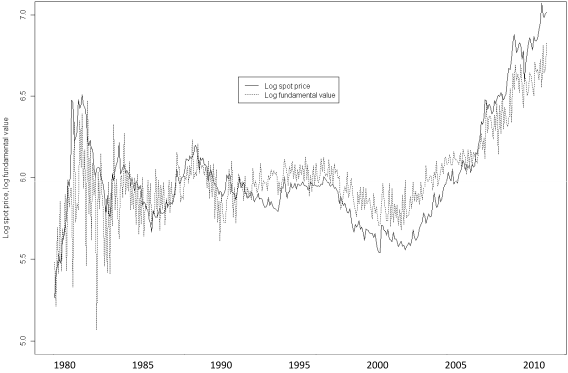

The following chart, taken from the paper, compares on a log scale the fundamental value of gold based on its commodity “dividend” stream and to its actual price. While the fundamental value is more volatile, the two series generally move together. Deviations from fair value are not explosive. Instead:

“The most likely explanation for our results is that three decades ago, skyrocketing inflation (caused by the second oil crisis and amplified by a very expansive monetary and fiscal policy) and geopolitical turmoil (especially due to the start of the Iran-Iraq war and the Soviet invasion of Afghanistan) caused financial market participants to look for stable investments in unstable times. Similarly, many investors have fled to gold as a safe haven in times of the recent world financial and the Greek sovereign debt crisis, causing excess demand and the corresponding price surge. Furthermore, given a very expansive monetary policy especially in the US, financial market participants expect both high future inflation and a weakening of the US dollar. Since gold is seen as a globally accepted currency which does not lose its purchasing power, they may have expanded its portfolio weight significantly.”

In summary, evidence from somewhat abstract and complex modeling favors a fundamentally justified price for gold over the the 20 years through March 2010.

Cautions regarding findings include:

- The commodity “dividend” is not an actual return stream for holders of gold, but only an advantage relative to those investing in gold via a rolling position in futures. This return stream is apparently gross, ignoring the costs of continually rolling futures contracts at a monthly frequency.

- It is not evident that the “fundamental valuation” method used supports a market-beating trading strategy based on either spot gold or gold futures.

An extension of the bubble detection analysis from March 2010 to the present would be interesting. See “Required Yield Theory of Gold Valuation” for a different approach to fundamental valuation of gold.