How can positions in emerging equity markets benefit investment portfolios? In their October 2012 paper entitled “How Large are the Benefits of Emerging Market Equities?”, Mitchell Conover, Gerald Jensen and Robert Johnson examine the returns of emerging equity markets with focus on: (1) performance measures that account for return distribution risk and abnormalities; (2) performance by region; and, (3) effects of global economic/monetary environment on returns and diversification power. Using monthly local-currency and dollar-denominated stock index returns and annual GDP estimates for 20 emerging markets as available, along with monthly returns for MSCI developed market MSCI indexes (including MSCI World and MSCI USA) for comparison, during January 1976 through December 2010, they find that:

- On a country-by-country, dollar-denominated basis:

- 14 of 20 emerging markets beat MSCI World based on gross geometric mean monthly return.

- However, all 20 emerging markets have higher standard deviations of monthly returns than MSCI USA.

- 11 of 20 emerging markets have gross monthly Sharpe ratios less than that of MSCI World.

- 17 of 20 emerging markets exhibit positive skewness and all exhibit excess kurtosis of monthly returns. 14 of 20 have gross monthly Sortino ratios higher than that of MSCI World, indicating that their “riskiness” derives substantially from upside variations.

- Correlations of gross monthly returns with MSCI World are below 0.40 for 14 of 20 emerging markets. For 16 of 20, correlations with MSCI USA are lower than those with MSCI World.

- 18 of the 20 emerging markets improve the gross mean-variance efficiency of MSCI World.

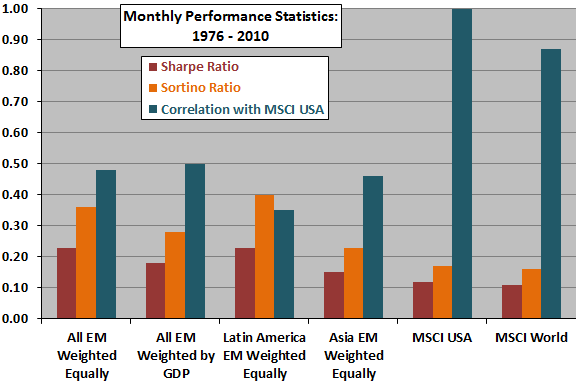

- On an aggregated, dollar-denominated basis (see the chart below):

- The equal-weighted index of all emerging markets beats MSCI World by a gross geometric mean return of 0.64% per month (about 7.7% per year). The equal-weighted Latin American index is optimal, with a gross geometric mean monthly return of 1.99%.

- The gross monthly Sortino ratio for the equal-weighted index of all emerging markets (0.36) is more than twice that of MSCI World and MSCI USA. The gross monthly Sortino ratio for the equal-weighted Latin American index is 0.40.

- Correlations of monthly returns with MSCI World are 0.56 for both the equal-weighted and GDP-weighted indexes of all emerging markets, while that for the equal-weighted Latin American index is only 0.37.

- The Latin American index consistently receives the largest allocations in efficient mean-variance frontiers formed from various equity indexes.

- Emerging markets, especially the Latin American index, are particularly effective as diversifiers of developed markets when:

- Inflationary pressure is high. The strong positive correlation of the Latin American index with U.S. inflation is consistent with heavy dependence of this index on commodities. In contrast, the emerging Asian index exhibits low or negative correlations with global inflation.

- Monetary policy is restrictive. Again, the Latin American index is particularly beneficial when monetary policy is restrictive due to low correlation and relatively strong returns.

The following chart, constructed from data in the paper, summarizes gross monthly Sharpe ratios, Sortino ratios and return correlations with MSCI USA for:

- An index of all 20 emerging markets (EM) weighted equally.

- An index of all emerging markets weighted by lagged GDP.

- An index of Latin American emerging markets weighted equally.

- An index of Asian emerging weighted equally.

- MSCI USA.

- MSCI World.

Results indicate the superiority of the Latin American index as a diversifier for U.S. investors based both on high risk-adjusted performance and low correlation.

In summary, evidence indicates that emerging markets (particularly Latin America) offer developed market investors substantial diversification benefits, especially when diversification is most needed.

Cautions regarding findings include:

- The study uses indexes rather than tradable assets. The costs of creating tradable assets that track these indexes (trading frictions, which are relatively high in emerging markets, and management fees) would reduce reported returns and may vary significantly across markets.

- It would be useful to know whether return correlations between emerging and developed markets have trended substantially upward, and differently so across emerging markets, over the sample period.