Are stock and bond markets mutually reinforcing with respect to time series (intrinsic or absolute return) momentum? In their December 2016 paper entitled “Cross-Asset Signals and Time Series Momentum”, Aleksi Pitkajarvi, Matti Suominen and Lauri Vaittinen examine a strategy that times each of country stock and government bond (constant 5-year maturity) indexes based on past returns for both. Specifically:

- For stocks, they each month take a long (short) position in a country stock index if past returns for both the country stock and government bond indexes are positive (negative). If past stock and bond index returns have different signs, they take no position.

- For bonds, they each month take a long (short) position in a country government bond index if past return for bonds is positive (negative) and past return for stocks is negative (positive). If past stock and bond index returns have the same sign, they take no position.

They call this strategy cross-asset time series momentum (XTSMOM). For initial strategy tests, they consider past return measurement (lookback) and holding intervals of 1, 3, 6, 9, 12, 24, 36 or 48 months. For holding intervals longer than one month, they average monthly returns for overlapping positions. For most analyses, they focus on lookback interval 12 months and holding interval 1 month. For a given lookback and holding interval combination, they form a diversified XTSMOM portfolio by averaging all positions for all countries. They measure excess returns relative to one-month U.S. Treasury bills. They employ the MSCI World Index and the Barclays Capital Aggregate Bond Index as benchmarks. Using monthly stock and government bond total return indexes for 20 developed countries as available during January 1980 through December 2015, they find that:

- Within-asset class lag analysis of monthly returns confirms that both country stock and bond indexes separately exhibit continuation over the first 12 months and reversal for longer lags.

- There is also evidence that past country stock (bond) index returns relate negatively (positively) to future country bond (stock) index returns, beyond within-asset class predictive powers, across a wide range of lookback and holding intervals.

- An XTSMOM portfolio diversified across countries and across lookback and holding intervals outperforms a comparable within-asset time series (TSMOM) portfolio based on gross Sharpe ratio in 18 of 20 countries.

- For a 12-month lookback interval and 1-month holding interval:

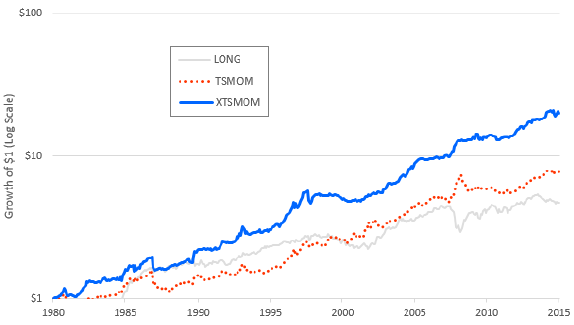

- An XTSMOM portfolio diversified across countries outperforms a comparable TSMOM portfolio (see the chart below).

- The XTSMOM portfolio generates incremental alpha after controlling for TSMOM.

- Slow-moving capital in stock and bond markets (derived from investor inattention, decision cycles and funding frictions) partly explain time series momentum.

- Simultaneously positive (negative) past 12-month stock and bond market returns tend to precede industrial production increases (decreases), unemployment decreases (increases) and below-average (above-average) inflation.

The following chart, taken from the paper, compares cumulative gross values of $1 initial investments in equal weighting of excess returns for positions in country stock market and government bond indexes specified as follows:

- LONG – buy and hold.

- TSMOM – based on 12-month lookback interval and 1-month holding interval for each index.

- XTSMOM – based on 12-month lookback interval and 1-month holding interval for each index.

For comparability, returns of each portfolio are scaled to 10% annualized volatilities. Results indicate that XTSMOM outperforms both LONG and XTSMOM.

In summary, evidence indicates that past country stock index (government bond index) returns relate positively (positively) to future country stock market index returns and negatively (positively) to future country government bond index returns.

Cautions regarding findings include:

- Reported performance data are gross, not net.

- Using indexes rather than tradable assets ignores costs/fees for maintaining liquid tracking funds.

- Buying and selling according to time series momentum signals involves trading frictions and shorting costs. Shorting of some country stock and government bond indexes may be problematic.

- Monthly rebalancing of stock and bond positions to equal weights likely involves material trading frictions.

- Introductory lag analyses that inform the cross-asset momentum strategy use the same data as strategy performance analyses, making the latter somewhat in-sample.

- The entire sample period is a strong bull market in bonds. Results may differ during a bond bear market.

- Sharpe ratio improvements for XTSMOM over TSMOM are modest for U.S., UK and Canada and absent for Japan.

- Since test portfolios are stocks and government bonds, both TSMOM and XTSMOM effects may derive from changes in the stocks-bonds return correlation (in addition to, or rather than, return enhancement).