What is the best way to include the least developed (frontier) stock markets for portfolio diversification? In his December 2011 paper entitled “Frontier Markets: Punching Below their Weight? A Risk Parity Perspective on Asset Allocation”, Jorge Chan-Lau compares the diversification effects of frontier markets within a world equity portfolio based on risk parity and market capitalization weighting approaches. Risk parity equalizes risk contributions across equity classes by assigning the same risk budget to each asset based on co-movement between the asset’s returns and the portfolio returns. The asset allocation comparison assumes five major equity classes: U.S., European including the UK, East Asia and Far East, emerging markets and frontier markets. Co-movement of asset and portfolio returns derive from weekly return measurements over five-year rolling historical windows. Using weekly returns in U.S. dollars for each equity class based on corresponding Morgan Stanley Capital Indexes during June 2002 through November 2011, he finds that:

- Frontier markets generally exhibit:

- Potential for fast economic growth based on favorable demographics and abundant natural resources.

- Vulnerability to large price correction during global shocks as investors prioritize risk reduction.

- Low correlation with other equity markets, including emerging markets.

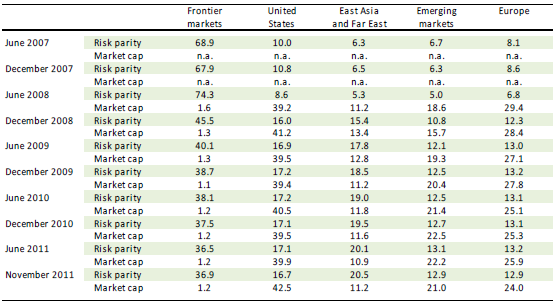

- Risk parity weights frontier markets far in excess of market capitalization (see the table below).

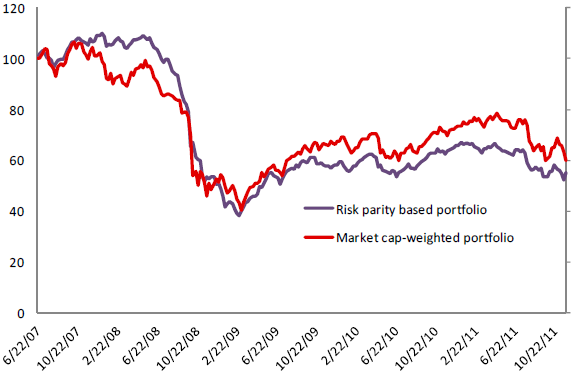

- A risk parity portfolio tends to outperform a market capitalization-weighted portfolio when markets are rising, while underperforming during crisis periods (see the chart below).

- High trading frictions (three times higher than in the U.S.), regulatory restrictions, foreign exchange risk, error-prone settlement systems, weak corporate governance standards and political instability inhibit diversification via frontier markets.

- Frontier markets are too small to accommodate broad inclusion on a risk parity basis, but portfolio managers still may accrue some diversification benefits by overweighting them relative to market capitalization.

The following table, taken from the paper, summarizes weights of the five global equity classes specified above based on risk parity and, as available, market capitalization at six-month intervals over the sample period based on five-year historical windows. Prior to the global crisis, before which frontier markets exhibit low volatility, the risk parity methodology weights frontier markets at about 70% of all equities, compared with a market capitalization weight of only 2%. After the 2008 volatility shock, the return correlation between frontier markets and global equities rises, and the allocation to frontier markets falls to about 40% of equities.

The following chart, also from the paper, compares the performance of global equity portfolios for risk parity and market capitalization weighting approaches with annual rebalancing during June 2007 through November 2011 (limited by availability of market capitalization data for frontier markets). The risk parity portfolio outperforms before the financial crisis, but underperforms during the crisis.

In summary, evidence from available data is mixed regarding the comparative diversification benefit of including frontier equity markets on risk parity versus market capitalization weighting.

Cautions regarding findings:

- The sample period is very short compared to the five-year lagged correlation calculation used for risk weighting.

- The analysis uses indexes. Transforming indexes into tradable assets incorporates trading frictions and management fees that may vary considerably by asset class, such that net returns are differently lower than gross index returns across classes.

- As noted by the author, frontier markets could not absorb the capital indicated by risk weighting. Results suggest that the risk parity allocation method can produce impractical allocations.

See the closely related “Frontier Market Costs and Benefits”.