Does the semantic tone of an earnings announcement, as measured independently of the level of earnings surprise, affect stock price reaction. In his September 2011 paper entitled “Short-term Reactions to News Announcements”, Michal Dzielinski investigates the effect of the tone (positive, neutral or negative) of the words in earnings announcements and other company news on stock prices from two days before to ten days after release. He averages news tone for each stock by day, with news released before (after) the market close counting as current-day (next-day) news. Using daily return data and over six million automatic, real-time Thomson Reuters news sentiment (tone) measurements (including those for over 68,000 earnings announcements) for 4,750 U.S. stocks during 2003 through 2010, he finds that:

- Positive average news days outnumber negative by at least 2:1 in all years of the sample period, with tone of headlines closely matching tone of associated entire releases.

- Across all news releases, stock prices tend to react in the same direction as news tone, with continuation lasting up to two days, followed by partial reversal.

- However, with regard to earnings announcements only:

- Stock prices tend to drift in the direction of the announcement-day jump during the next two weeks without reversal. In other words, the overall finding of partial reversal comes from non-earnings news.

- Announcements of large positive (negative) surprises often (rarely) have negative (positive) headlines.

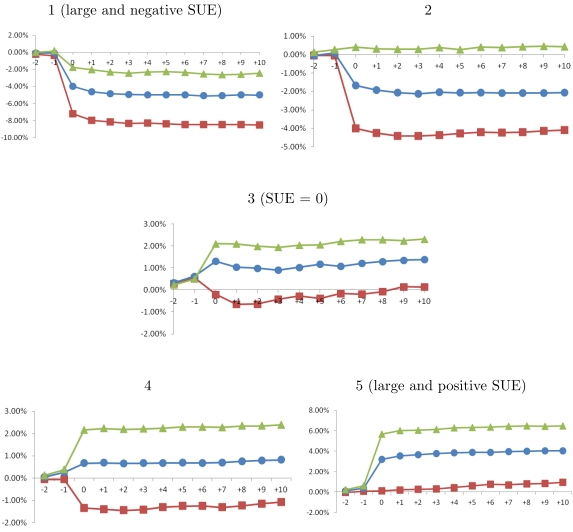

- Controlling for level of earnings surprise, the difference in announcement-day returns between positive and negative headlines is as large as 6%. The effect of tone on the return persists for at least two weeks, but tone does not effect the slope of subsequent drift (see the chart below).

- Results suggest that investors:

- Overreact to relevant but relatively unimportant news.

- Underreact to important fundamental news.

- React differently to important fundamental news according to the tone of its delivery.

The following set of five charts, taken from the paper, plots average cumulative abnormal returns from two trading days before (-2) through ten days after (10) earnings announcements for sampled stocks grouped by quintile of standardized unexpected earnings (SUE). Each chart shows cumulative returns for earnings announcement headlines with positive tone (green triangles), neutral tone (blue circles) and negative tone (red squares).

Results show that the tone of earnings announcements substantially affects how strongly investors initally react to earnings surprises, but not the slope of subsequent drift.

In summary, evidence indicates that the tone in earnings announcements affects immediate investor reaction to earnings surprises in the direction of the tone and that the effect is persistent.

Cautions regarding findings include:

- Use of close-to-close returns obscures exploitability of findings (much of earnings announcement day jumps likely occur in unpredictable gaps).

- Clustering of earnings announcements across companies may inhibit portfolio-level implementation, and volatility of results across announcements may disrupt portfolio performance.

See also “Short-term News Premium for Individual Stocks” for similar research from the same author.