Under current U.S. accounting rules, many investments in innovation, human resources and brand that are crucial to long-term competitiveness immediately reduce operating profits and earnings (are expensed rather than capitalized). Does failure to incorporate such intangible investments in firm investment and valuation ratios (book-to-market, profitability and return on equity) harm equity investment decisions? In their January 2021 paper entitled “Intangible Capital in Factor Models”, Huseyin Gulen, Dongmei Li, Ryan Peters and Morad Zekhnini study impacts of capitalizing intangible investments on three widely used factor models of stock returns: 3-factor (market, size, book-to-market); 5-factor (adding profitability and investment); and, q-factor (market, size, investment, profitability). They focus on effects of intangibles on book-to-market ratio, investment and profitability. Using accounting data and stock returns for a broad sample of U.S. firms during July 1977 through December 2018, they find that:

- Over the full sample period, extreme tenth (decile) hedge portfolios based on conventional book-to-market, profitability and return on equity generate gross average value-weighted monthly returns 0.37%, 0.40% and 0.69%, respectively. Corresponding returns for capitalized intangibles are 0.62%, 0.24% and 0.98%.

- Incorporating capitalized intangibles into value and profitability factors of the above 3-factor, 5-factor and q-factor models substantially improves contributions from these two factors, especially in recent decades as intangibles grow.

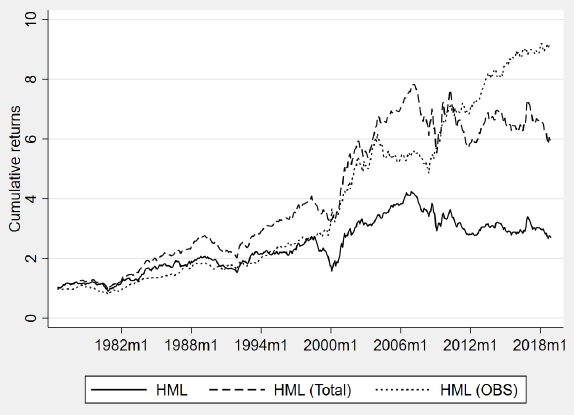

- During July 1977 through December 1996, the average monthly gross premium for the conventional (intangibles-only) value factor is 0.37% (0.39%). During January 1997 through December 2018, the conventional (intangibles-only) monthly value premium is 0.10% (0.52%). Over the full sample period, combined conventional-intangibles monthly value premium is 0.38%, compared to 0.23% for the conventional premium (see the chart below).

- During July 1977 through December 1996, the average monthly gross premium for the conventional (combined conventional-intangibles) profitability factor is 0.34% (0.31%). During January 1997 through December 2018, the conventional (combined conventional-intangibles) value premium is 0.34% (0.43%).

- Capitalization of intangibles does not improve performance of the conventional investment factor.

- Incorporating intangibles substantially improves overall abilities of 3-factor, 5-factor and q-factor models to explain stock returns, especially over recent decades. The modification especially improves performance of the 3-factor model compared to the 5-factor and q-factor models.

The following chart, taken from the paper, compares cumulative gross value premiums for three variations of the value factor over the full sample period:

- HML – conventional hedge portfolio based on High-Minus-Low book-to-market ratios.

- HML (Total) – HML calculated with combined conventional-intangibles book values.

- HML (OBS) – HML calculated with book values based only on capitalized (Off-Balance-Sheet) intangibles.

Performances of HML and HML (OBS) diverge dramatically beginning about 2000, reflecting strong growth in intangible investments.

In summary, evidence indicates that capitalization of intangible investments substantially boosts performance of widely used factor models of stock returns via value and profitability factor improvements.

Cautions regarding findings include:

- Factor and factor model performance statistics are gross, not net. Accounting for periodic factor portfolio reformation frictions and shorting costs would reduce all returns. Shorting may not always be feasible as specified.

- Forming and maintaining factor/multi-factor stock portfolios is beyond the reach of most investors, who bear fees for delegating this work to a fund manager.

- Experimentation with factor model design introduces data snooping bias, such that the best-performing models overstate expectations.