Does market-driven deviation of the price of an exchange-traded fund (ETF) from its net asset value (NAV) predict an exploitable future return? In the September 2012 draft of their paper entitled “Reading Tomorrow’s Newspaper: Predictability in ETF Returns”, Jon Fulkerson and Bradford Jordan examine the relationship between price-to-NAV ratio and next-day return for ETFs. Using daily opening and closing prices for 762 equity ETFs and their components as available during January 2000 through early February 2011 equity, with the extreme 1% of recorded price-to-NAV values trimmed to exclude data entry errors, they find that:

- Over the sample period, equity ETFs have:

- Average close-to-open (open-to-close) return 0.08% (-0.05%), with standard deviation about 3% (3%).

- Average (median) price-to-NAV ratio 1.0009 (1.0002), ranging from 0.991 for the bottom decile to 1.015 for the top.

- Average (median) bid-ask spread 0.39% (0.17%).

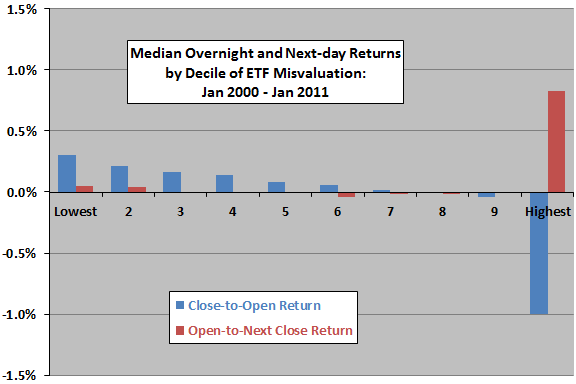

- During the 24 hours after price-to-NAV measurement at market close (see the chart below), ETFs in the:

- Lowest decile have an average gross close-to-open (open-to-next close) return of 0.3% (0.05%), with 52% of open-to-next-close returns positive.

- Highest decile have an average gross close-to-open (open-to-next close) return of -1.0% (0.83%), with 75% of open-to-next-close returns positive.

- Result are generally robust to equal subperiods and controls for bid-ask bounce, ex-dividend days and market trend.

The following chart, constructed from data in the paper, summarizes average gross returns by daily ETF price-to-NAV ratio decile over the sample period. Close-to-Open returns are from the daily ratio calculation point (market close) to the next open and are thus not exploitable. Open-to-Next Close returns are from next open to next close and are exploitable.

Given a typical bid-ask spread of 0.2%-0.4%, the large Open-to-Next Close return for the highest price-to-NAV ratio decile may be exploitable.

In summary, evidence suggests that traders may be able to exploit an abnormally large positive open-to-next close return for ETFs that are extremely overvalued with respect to NAV at the prior close.

Cautions regarding findings include:

- As noted in the paper, findings are weaker for the second half of the sample period than the first, indicating diminished exploitability.

- The highest decile of price-to-NAV ratios may relate to atypically illiquid ETFs with relatively large bid-ask spreads, thereby undermining exploitability.