Is there a way to tell which corporate executives are manipulating earnings? In their November 2016 paper entitled “Expectations Management and Stock Returns”, Jinhwan Kim and Eric So examine the relationship between firm incentives to manage earnings and stock returns around earnings announcements. They define an expectations management incentives (EMI) indicator that combines three groups of incentives:

- Attention – the extent of external scrutiny of reported earnings, consisting of analyst coverage and institutional ownership.

- Resources – the capacity to manage expectations, consisting of cash reserves and shareholder equity.

- Pressure – unsustainable growth expectations, measured by trailing sales growth.

Specifically, monthly EMI is average percentile rank of analyst coverage, institutional ownership, shareholder equity per share, cash per share and sales growth, divided by the difference between the maximum and minimum percentiles of these characteristics, all as of 12 months ago. Using the specified data and associated returns for a broad sample of U.S. stocks encompassing about 420,000 quarterly earnings announcements during 1985 through 2015, they find that:

- Based on raw returns:

- The fifth (quintile) of stocks with highest EMIs outperform the quintile with the lowest EMIs by a value-weighted (equal-weighted) 1.03% (1.00%) during quarterly announcement months.

- The quintile of stocks with highest EMIs underperform the quintile with the lowest EMIs by an average 0.40% in each of the two months prior to earnings announcement months.

- Adjusting for size, book-to-market, momentum, return reversal, abnormal analyst coverage and post-earnings announcement drift characteristics, the quintile of stocks with highest EMIs outperform the quintile with the lowest EMIs by a value-weighted (equal-weighted) 0.69% (0.58%).

- Firms with high EMI tend to:

- Issue earnings guidance that is below both previously reported earnings and prevailing consensus analyst forecast.

- Beat analyst forecasts even when earnings decline.

- Beat expectations narrowly much more often than miss narrowly.

- Issue press releases with tone more negative than justified by contemporaneous changes in quarterly profits.

- Be young.

- Findings are robust to alternative measures of expectations management incentives.

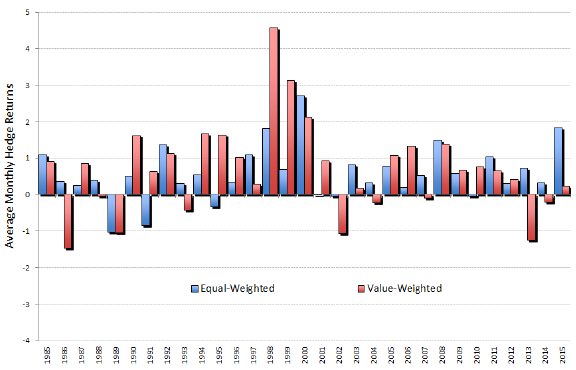

The following chart, taken from the paper, shows equal-weighted (blue) and value-weighted (red) monthly characteristic-adjusted returns for a portfolio that is each month long the highest EMI quintile of stocks and short the lowest EMI quintile by calendar year. Characteristics included in return adjustments are size, book-to-market, momentum, return reversal, abnormal analyst coverage and post-earnings announcement drift. Results indicate that the EMI effect is fairly consistent over the sample period.

In summary, evidence indicates that some firms predictably influence investor expectations to manufacture positive earnings surprises.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for trading frictions and shorting costs would reduce these returns. Shorting may not be feasible for some low-EMI stocks.

- EMI tracking and associated portfolio management are beyond the reach of most investors, who would bear fees for delegating these processes.

- Average event (earnings release) returns do not take into account complications of capital allocation/position sizing when events overlap. Maintaining cash reserves for new opportunities would lower portfolio returns.