Can investors usefully apply stock quality metrics to entire country stock markets? In his December 2014 paper entitled “Country Selection Strategies Based on Quality”, Adam Zaremba investigates whether quality metrics effectively predict country stock market index performance. He also examines whether (1) quality-size and quality-value double sorts enhance country-level value and size strategies; and, (2) high-quality markets offer a hedge during times of market distress. He considers six quality metrics: accruals, cash (cash divided by total assets), profitability (return on assets), leverage (total assets divided by common equity), payout (dividends as a fraction of income) and turnover (dollar volume of trading divided by market capitalization). Firm metric aggregation weightings are those used in constructing respective country indexes. After lagging the time series by three months to avoid a look-ahead bias, he forms capitalization-weighted portfolios of country markets by ranking them into fifths (quintiles) based on quality metric sorts. He identifies times of market distress based on: the spread between U.S. LIBOR and U.S. Treasury bill yields; VIX; the spread between U.S. corporate BBB bond and 10-year U.S. Treasury note yields; and, the spread between U.S. Treasury 10-year and 2-year note yields. Using stock market index returns and accounting data in U.S. dollars across 77 country stock markets during February 1999 through September 2014 as available, and contemporaneous market distress indicator values, he finds that:

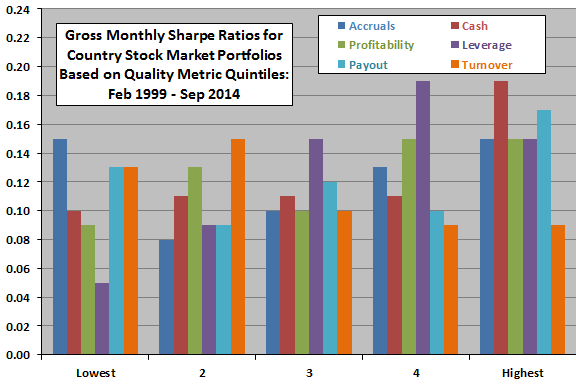

- Country stock markets with very low aggregate leverage and high aggregate cash tend to have higher average gross returns and gross Sharpe ratios than those with very high leverage and low cash (see the chart below).

- Strategies based on leverage and cash tend to work better for small country stock markets than large ones.

- Additional sorts on leverage and profitability markedly improve performance of country stock market value (aggregate book-to-market ratio) strategies.

- High-quality country stock markets do not serve as a hedge against market distress.

The following chart, constructed from data in the paper, summarizes gross monthly Sharpe ratios across quintiles of country stock markets sorted on the six quality metrics. “Lowest” (Highest”) always denotes the lowest (highest) quality.

Overall, results weakly suggest that high quality outperforms low quality, but lack of systematic progressions across quintiles and sometimes modest differences between the highest and lowest quality quintiles (zero for accruals and negative for turnover) undermine confident belief. The largest differences between extreme high and low quintiles are for the leverage and cash metrics.

In summary, evidence suggests that investors may be able to enhance international diversification modestly by focusing on country markets with conservative aggregate firm financing.

Cautions regarding findings include:

- The sample period is not long in terms of number of economic/market cycles.

- As noted in the paper, the sample of countries is not large.

- Access to country stock market quality indicators may be costly.

- Use of index returns ignores any costs of maintaining a liquid tracking fund. These costs would lower reported returns.

- Moreover, as noted in the paper, quintile portfolio performance ignores trading frictions and tax implications of monthly reformation (and shorting costs for long-short portfolios). These costs may be high for some markets.

- Use of multiple quality metrics introduces snooping bias, such that the most effective metrics likely overstate expected performance.

See also the closely related “Stock Markets Have Quality, Too?”.