Several readers have inquired or commented about the accuracy of Standard and Poor’s quarterly S&P 500 earnings estimates. How accurate have they been? Since late 2005, we have tracked the evolving bottoms-up S&P 500 year-over-year quarterly operating earnings growth estimates for 2006-2009 at roughly biweekly intervals. During the early part of this period, we recorded the average of the publicly available Standard and Poor’s and Reuters earnings estimates (generally similar). During the latter part, we recorded only the Standard and Poor’s estimates. Using evolving earnings forecasts for 2006-2009, we find that:

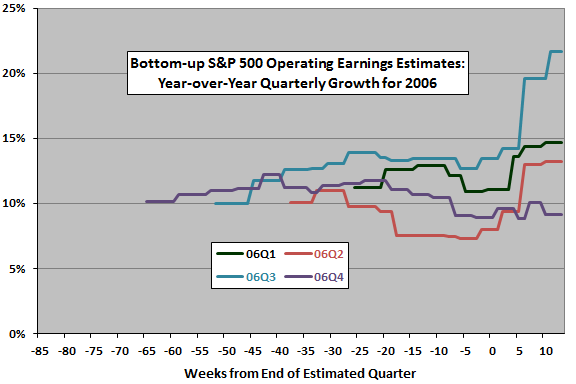

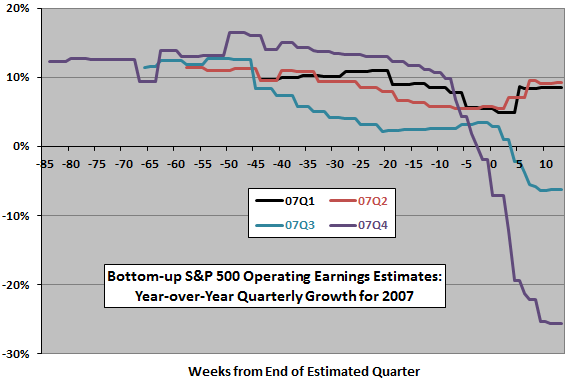

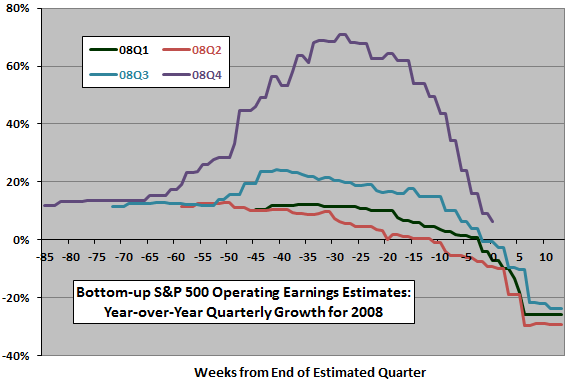

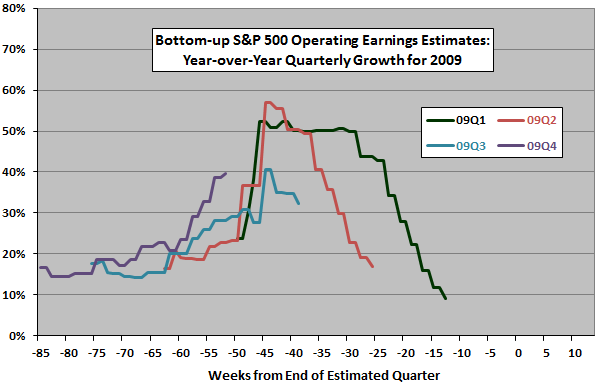

The following four charts trace the approximate evolutions of bottoms-up S&P 500 year-over-year quarterly operating earnings growth estimates for 2006, 2007, 2008 and 2009, respectively. The horizontal axes measure weeks from the end of the estimated quarter, so negative numbers are weeks before the end of the quarter. Negative values on the vertical axes indicate that estimated quarterly earnings are lower than those of the year-ago quarter.

For 2006, forecasters initiate quarterly earnings growth estimates at about +10% to +11%. Prior to the ends of quarters, estimates are generally steady. Adjustments after the ends of the quarters (earnings seasons) are mostly positive and concentrated five to seven weeks after ends of quarters. In other words, earnings surprises are mostly positive in 2006.

For 2007, forecasters initiate quarterly earnings growth estimates at about +10% to +12%. Prior to the ends of quarters, estimates generally drift downward, sharply so for the fourth quarter. Adjustments after the ends of the quarters (earnings seasons) are positive for the first two quarters and negative for the last two quarters, and concentrated three to seven weeks after quarter ends. In other words, earnings surprises are mildly positive for the first two quarters and substantially or dramatically negative for the last two quarters in 2007.

For 2008, forecasters initiate quarterly earnings growth estimates at about +10% to +12%. Prior to the ends of quarters, estimates generally drift downward. The early rise in the growth estimate for the fourth quarter parallels the sharp decline in the growth estimate for the fourth quarter of 2007 (the comparison quarter). Adjustments after the ends of the quarters (earnings seasons) are sharply negative for the first three quarters (and not yet know for the last quarter), again concentrated three to seven weeks after quarter ends. In other words, earnings surprises are dramatically negative for all quarters so far in 2008.

For 2009, forecasters initiate quarterly earnings growth estimates at about +16% to +24% (knowing that comparable 2008 quarters are weak). Prior to the ends of quarters, growth estimates first rise as those for comparable 2008 quarters deteriorate and then (for the first two quarters so far) begin sharp declines.

In summary, recent S&P 500 aggregate bottoms-up earnings growth estimates have often been highly variable and substantially inaccurate.

Although we did not record the data, we recall that evolutions of S&P 500 bottoms-up operating earnings growth estimates for much of 2003-2005 looked something like 06Q3. It may be that early overestimates (underestimates) are typical of bear (bull) stock markets. In other words, the stock market predicts actual earnings growth better than do expert forecasters.