“Evolution of Bitcoin as an Investment” suggests a shift toward acceptance of Bitcoin (BTC) as an investment asset, as do recent actions by some large investors. Grayscale Bitcoin Trust (GBTC) offers a way for investors to access BTC via a fund that manages BTC holdings. GBTC price generally carries a premium over its BTC holdings in consideration for this convenience (17% as of the end of 2020). Does variation in this premium indicate good times to buy and sell GBTC? To investigate, we use the ratio GBTC/BTC (with BTC divided by 1,000 because the prices greatly differ in scale) as an easy way to infer the premium. We then look at ways to exploit variation in the ratio to buy and sell GBTC. Because of the rapid evolution of Bitcoin, we limit analysis to recent data. Using daily closing prices of GBTC and BTC during 2019 through 2020, we find that:

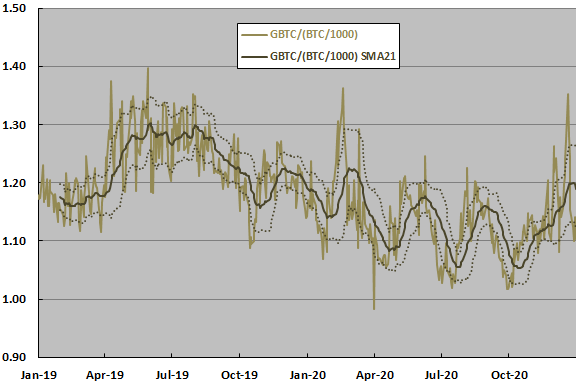

The following chart tracks GBTC/(BTC /1,000). The series appears not to have a stable average over the sample period, so using historical average as an anchor is problematic. Instead, we calculate the 21-day simple moving average (SMA21) as an anchor series. Dotted lines show one standard deviation of daily changes in the ratio over the past 21 trading days above and below SMA21.

When GBTC/(BTC/1,000) is relatively high (low), the GBTC premium is relatively high (low) suggesting a good time to sell (buy) GBTC. Crosses of SMA21 or the SMA21 one standard deviation bands may therefore be useful as trading signals.

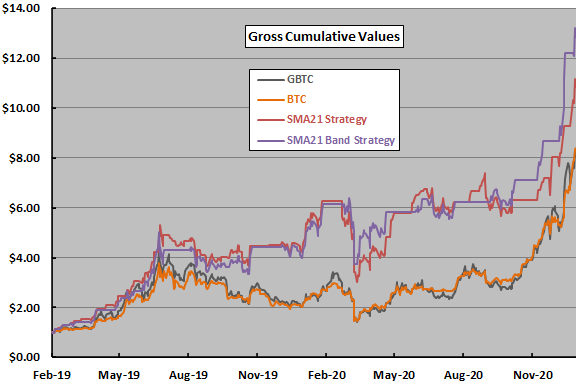

The next chart tracks cumulative gross values of $1 initial investments in each of four strategies:

- GBTC – buy and hold GBTC.

- BTC – buy and hold BTC.

- SMA21 Strategy – buy (sell) GBTC when the inferred GBTC premium crosses below (above) its SMA21.

- SMA21 Band Strategy – buy (sell) GBTC when it crosses below the SMA21 one standard deviation lower band (crosses above the upper band).

We initiate tracking with the first SMA21 Band Strategy buy signal at the close on 2/4/19. We assume trades occur at the same close as trading signals, ignore trading frictions and assume zero return on cash when out of GBTC. Results suggest that the timing signals are useful and that SMA21 Band Strategy is probably preferable to SMA21 Strategy.

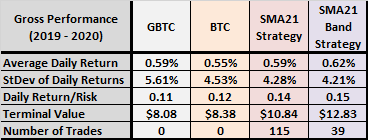

The following table summarizes some performance statistics for the above four strategies. Daily return/risk is average daily return divided by standard deviation of daily returns. The much lower number of trades for SMA21 Band Strategy compared to SMA21 Strategy amplifies preference for the former.

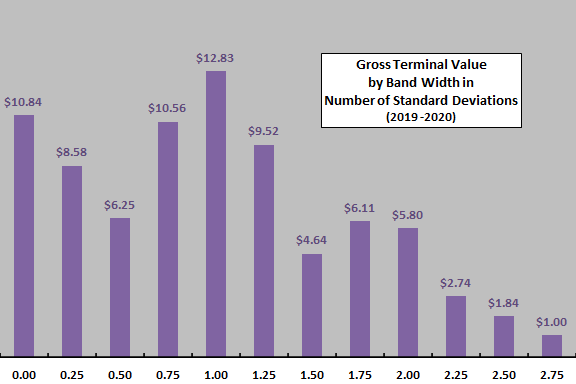

Are results for SMA21 Band Strategy sensitive to the choice of one standard deviation bands?

The final chart summarizes gross terminal values for the SMA21 Band Strategy for bands ranging in distance from 0.00 to 2.75 standard deviations in increments of 0.25. The value for 0.00 standard deviations is the same as that for the SMA21 Strategy.

Results suggest that one standard deviation bands are lucky and may not improve terminal value in new data.

In summary, evidence from a very short sample suggests that SMA signals applied to the GBTC premium may be useful for valuation-based trading.

Cautions regarding findings include:

- The sample period is very short, only 24 independent 21-day intervals. Though GBTC has been trading since May 2015, immaturity of the BTC market undermines confidence in use of the full series.

- As noted, performance data are gross, not net. GBTC is reasonably liquid, but trading frictions are material for the timing strategies.

- Some anchor other than SMA21 and some measurement frequency other than daily may work better (SMA18 through SMA22 all beat buying and holding GBTC). However, experimentation without strong theory would introduce data snooping bias, such that improvements would overstate expectations.

- As noted, the one standard deviation bands appear lucky and are suspect for future use.

- Variation in underlying BTC price also affects GBTC. Such variation may be related to variation in the GBTC premium.

See results of this search for other Bitcoin-related research.