Do individuals who actively reallocate funds within their pension accounts outperform passive counterparts? In the March 2014 update of their paper entitled “Individual Investor Activity and Performance”, Magnus Dahlquist, Jose Vicente Martinez and Paul Soderlind examine the activity and performance of individual participants in Sweden’s Premium Pension System. This system allows individual participants to reallocate among available mutual funds on a daily basis with no switching fees/impediments. Information about the 1,230 funds offered during the sample period includes type (fixed income, balanced, life-cycle and equity), return and risk measured at several horizons, fee and major holdings. Most are equity funds, about half of which invest primarily in international equities. The government assigns individuals who make no choice to a default fund. Using daily net returns, fund trades and demographics for 70,755 individuals (from a random draw of individuals in the system over the entire period) and contemporaneous returns for several benchmarks during September 2000 through May 2010, they find that:

- About 69% of system participants (30% in the default fund and 39% in initial selections) make no change in allocation over the sample period.

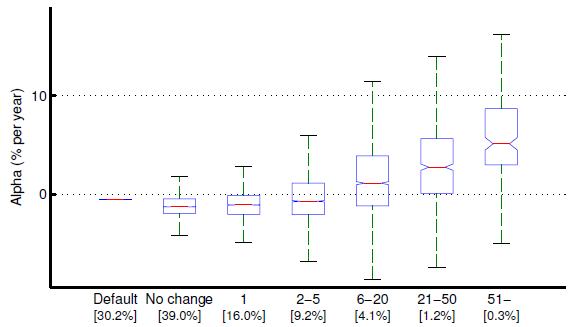

- Individuals who make an initial selection but no subsequent changes earn an average annual return of 1.7%, compared to 2.5%-8.6% for those who change allocations. Both raw and risk-adjusted average returns increase systematically with level of switching activity (see the chart below). Based on regression, ten fund changes relate to a 1.1% performance improvement.

- On average, individuals replace half of their portfolios when changing funds. Trading patterns and outcomes indicate that:

- Outperformance of active fund traders derives primarily from switching funds within an asset class (fund selection) and not across asset classes (market timing).

- Active traders pursue momentum-like strategies (which would likely be costly to implement outside the subsidized pension system).

- Most of the benefits from trading accrue during the first month after changes, corresponding to the average holding interval of the most active investors.

- Roughly 10% of system participants exhibit coordinated trading, attributable to common financial advisors. Coordinated investors accounted for about 80% of all fund changes in 2010, but only the most active among them outperform benchmarks.

- While men and trade more frequently than women and high-income individuals trade more frequently than low-income individuals, results generally hold after controlling for age, gender and income.

The following chart, taken from the paper, shows the median (red line), 25th-75th percentile range (blue boxes) and 95% range (black lines) of alphas for non-coordinated pension system participants ranked by level of trading activity over the entire sample period. Alpha is relative to daily returns of the Swedish stock market, the Swedish bond market and the world stock market. The “Default” category consists of individuals that make no initial fund selection and do not trade. The “No change” category consists individuals who make an initial fund choice but no subsequent changes. Other categories consist of individuals who have reallocated one or more times. Below each category is the percentage of the sample in it.

Results indicate that more frequent reallocation means better performance. However, 94.4% of the population earn slightly negative alphas.

In summary, evidence from Sweden’s Premium Pension System indicates that active mutual fund traders tend to outperform passive participants, when there are no trading frictions/impediments (in other words, when passive investors subsidize costs of momentum trading by active investors).

Active mutual fund traders unprotected from switching frictions/impediments may perform differently.

Findings offer some indication that momentum trading of funds, with low trading frictions/impediments, may beat the market.