How has the market environment changed with the introduction of zero-commission trading and associated interest in trading among many inexperienced users? In their January 2021 paper entitled “Zero-Commission Individual Investors, High Frequency Traders, and Stock Market Quality”, Gregory Eaton, Clifton Green, Brian Roseman and Yanbin Wu examine market implications of growth in trading by a new subclass of retail investors represented by Robinhood users, focusing on January 2020 through August 2020 when the number of Robinhood users becomes very large. They isolate Robinhood user impacts by comparing market behaviors during Robinhood outages (real-time complaints by at least 200 Robinhood users on DownDetector.com) to those during similar times of day the prior week. They rely on the Reddit WallStreetBets forum and lagged trading activity to identify which stocks Robinhood users would have traded during outages. Using hourly (normal market hours) breadth of stock ownership data for Robinhood users from Robintrack (stocks with minimum average ownership 500 and daily minimum owners 50) and associated stock trading data during July 2018 through August 2020 (when the RobinTrack dataset ends), they find that:

- Robinhood ownership changes are unrelated to future returns at horizons up to 20 trading days. Although other retail traders in aggregate appear to invest in the same stocks as Robinhood users, their trading leads that of Robinhood users by several days.

- Overall, WallStreetBets stock mentions and lagged Robinhood stock ownership changes strongly predict future ownership changes.

- During Robinhood outages (see the chart below), stocks favored by Robinhood users (per WallStreetBets mentions):

- Have significantly lower trading frequencies and volumes (an average 6.2% fewer trades).

- Exhibit increased market liquidity (smaller quoted spreads, effective spreads, realized spreads and price impacts of trading) and lower volatility (based on 5-minute returns).

- Have lower high-frequency trader (HFT) counterparty activity (strategic runs, order-to-trade ratios and cancel-to-trade ratios), suggesting HFTs reduce trading due to lack of insight regarding Robinhood trading.

- Robinhood outages have strongest impacts on stocks neglected by HFTs, suggesting that zero-commission traders negatively affect market quality.

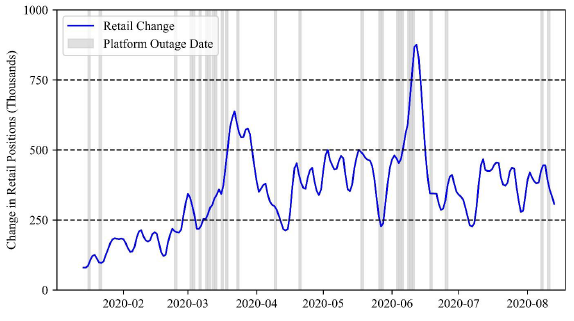

The following chart, taken from the paper, shows absolute value of hourly changes of Robinhood user positions (Retail Change) and days with Robinhood outages as defined above during normal trading hours during mid-January 2020 through August 2020. Outages are key to estimating impacts of Robinhood users on market behaviors.

In summary, evidence indicates that the new subclass of zero-commission traders on Robinhood are uninformed and generally reduce market liquidity.

It appears that such traders are “paying” for zero commissions in the form of higher trading frictions and returns transferred to some HFTs.

Cautions regarding findings include:

- The sample period is very short, and findings may be transitory as the marketplace adapts (as in termination of RobinTrack data collection).

- In general, zero-commission brokers must devise other sources of revenue via means potentially harmful to client interests.

For related research, see results of this search.