In the preface to his 2015 book entitled Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk, author Gary Antonacci states: “We need a way to earn long-term above-market returns while limiting our downside exposure. This book shows how momentum investing can make that desirable outcome a reality. …the academic community now accepts momentum as the ‘premier anomaly’ for achieving consistently high risk-adjusted returns. Yet momentum is still largely undiscovered by most mainstream investors. I wrote this book to help bridge the gap between the academic research on momentum, which is extensive, and its real-world application… I finally show how dual momentum—a combination of relative strength and trend-following…is the ideal way to invest.” Based on a survey of related research and his own analyses, he concludes that:

From Chapter 1, “World’s First Index Fund” (Page 11): “After years of momentum research by many academics, even Eugene Fama and Kenneth French, two of the founders of EMH [Efficient Market Hypothesis], began paying attention to momentum, which they called the ‘premier anomaly.’ Momentum was powerful, persistent, and not explainable by any of the commonly known risk factors.”

From Chapter 2, “What Goes Up…Stays Up” (Pages 23-24): “All of these publicly available products apply relative strength momentum to individual stocks. They therefore miss the potential risk-reducing benefits of cross-asset diversification. Using momentum with individual stocks also results in substantially higher transaction costs than applying momentum to broad asset classes and indexes. Also important is the fact that while relative strength momentum can enhance returns, it does little to reduce volatility or maximum drawdown. These risks may even increase compared to similar portfolios using nonmomentum, buy-and-hold strategies.”

From Chapter 3, “Modern Portfolio Theory Principles and Practices” (Page 34): “While academics remained busy engineering more complex ways to model financial markets, simple momentum has stood the test of time as the premier market anomaly.”

From Chapter 4, “Rational and Not-So-Rational Explanations of Momentum” (Page 43): “…momentum is not just a 212-year flash in the pan. There are logical reasons why momentum works—and, in fact, there are plenty of them.”

From Chapter 5, “Asset Selection: The Good, the Bad, and the Ugly” (Page 70): “Today’s overemphasis on diversification often leads to mediocrity and unnecessary expense. …Without discrimination, diversification can become “deworsification.” …low-cost equity and fixed-income index funds, appropriately selected by dual momentum, are all that one needs for investment success.”

From Chapter 6, “Smart Beta and Other Urban Legends” (Page 79): “Rather than deal with all this complexity and uncertainty [of smart beta strategies], for most investors, simply using traditional capitalization-weighted indexes is most likely a better approach. Smart beta investors may…be able to capture the same incremental returns from just a rebalanced stock/bond or sector portfolio.”

From Chapter 7, “Measuring and Managing Risk” (Pages 85, 87, 89): “Absolute momentum is roughly the same as relative momentum applied to an asset paired up with Treasury bills. …The biggest advantage of absolute momentum over relative momentum…is its ability to reduce dramatically portfolio downside vulnerability by exiting positions early during bear markets. …The best approach is to use absolute and relative together in order to gain the advantages of both. The way we do that is by first using relative momentum to select the best-performing asset… We then apply absolute momentum as a trend-following filter…”

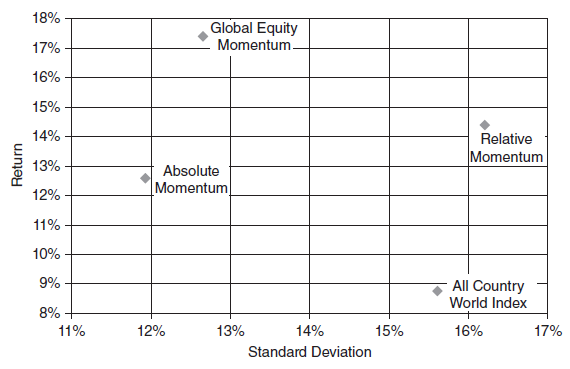

From Chapter 8, “Global Equities Momentum” (Pages 94, 103): “Dual momentum can take us from naive diversification to a dynamically adaptive asset allocation approach that keeps us better in tune with changing market regimes and less exposed to converging market correlations. …Over this entire 40-year period [1974-2013], GEM has an average annual return of 17.43% with a 12.64% standard deviation, a 0.87 Sharpe ratio, and a maximum drawdown of 22.7%. This almost doubling of the annual rate of return over ACWI [MSCI All Country World Index] comes with a reduction in volatility of 2%. The Sharpe ratio quadruples, and the maximum drawdown drops by nearly two-thirds. …As an indication of robustness, GEM also showed consistency throughout the data, having much higher Sharpe ratios and lower maximum drawdowns than ACWI during each of the four decades.” [See the figure below.]

From Chapter 9, “Mo’ Better Momentum” (Page 116): “With so much going for dual momentum, if you try to replace or modify this proven approach with something new, you face several potential problems. First is the multiple-comparisons hazard that comes from data mining when it becomes data snooping. If you look at enough different strategies, almost certainly a few of them will look attractive. However, this simply can be due to chance or luck. …By adding complexity to a model, you may make it too rigid by molding it perfectly to ‘predict’ the past.”

From Chapter 10, “Final Thoughts” (Pages 138-139): “There will undoubtedly be periods when dual momentum underperforms its benchmarks. During those times, investors may lose sight of the big picture and be tempted to behave in ways that hurt them in the long run. The main challenge facing dual momentum investors in the future may very well be their own willingness to follow the model patiently and with the requisite discipline.”

The following figure, taken from the book, compares gross average annual return-annual volatility relationships for four strategies during 1974 through 2013 (40 years):

- All Country World Index – buy and hold the GSCI All Country World Index (ACWI).

- Absolute Momentum – apply absolute momentum to ACWI by each month holding ACWI or Barclays U.S. Aggregate Bond Index according to past performance of ACWI.

- Relative Momentum – apply relative momentum to ACWI by by each month holding the S&P 500 Index or ACWI ex-U.S., according to their relative past performance.

- Global Equity Momentum: combine absolute and relative momentum by applying the monthly GEM strategy outlined in Chapter 8 of the book.

The figure shows that Absolute Momentum outperforms buying and holding ACWI by boosting gross average return and suppressing volatility. Relative Momentum also boosts gross average return, but with somewhat elevated volatility compared to buy-and-hold. In combination (Global Equity Momentum), the two types of momentum strongly boost gross average return while suppressing volatility.

In summary, investors will find Dual Momentum Investing a useful synthesis of the stream of research on relative and absolute (or time series or intrinsic) momentum applied simply in combination to a few asset classes.

Cautions regarding conclusions include:

- Per the assumptions regarding Global Equities Momentum strategy performance in Appendix A of the book: “All performance represents total returns and includes reinvestment of interest and dividends but does not reflect possible management fees, transaction costs, taxes or other expenses.” These frictions would reduce reported performance. More specifically, frictions may include:

- Management/administrative fees imposed and trading frictions incurred by fund managers in maintaining liquid tracking funds for the underlying indexes.

- Trading frictions incurred directly for any changes in positions based on monthly calculations.

- Trading frictions incurred directly from reinvestment of interest and dividends.

- The sample period is not long in terms of secular economic/market trends that may affect strategy performance. For example, much of the 1974-2013 sample period encompasses a secular decline in interest rates and attendant bull market in intermediate-term bonds. The strategy may not work as well during a secular rise in interest rates and attendant bond bear market.

See “Intrinsic Momentum Across Asset Classes” for a summary of the paper that appears as Appendix B of the book. See also “Which Kind of (ETF) Momentum Is Best?” and “Melding Momentum, Diversification and Absolute Return” for summaries of other papers by the author.