Are moody investors prone to avoid risk on Monday and accept it on Friday? In his January 2016 paper entitled “Day of the Week and the Cross-Section of Returns”, Justin Birru examines how long-short U.S. stock anomaly portfolio returns vary by day of the week. His hypothesis is that pessimistic (optimistic) mood on Monday (Friday) leads to relatively low (high) returns for speculative stocks. His analysis focuses on 14 anomalies arguably tied to investor sentiment, with one side (short or long) speculative and the other side non-speculative, based on idiosyncratic volatility, lottery-like, firm age, distress, profitability, payouts, size or illiquidity. He also tests anomalies arguably unrelated to investor sentiment based on momentum, book-to-market, and asset growth. Using anomaly variable and return data for a broad sample of U.S. common stocks during July 1963 through December 2013, he finds that:

- Stocks most affected by investor sentiment (volatile, lottery-like, young, distressed, unprofitable, non-dividend paying, small and low-priced) tend to underperform on Mondays and outperform on Fridays.

- Long-short anomaly portfolios for which the short (long) side is the speculative side exhibit:

- Highest (lowest) returns on Monday (Friday).

- Systematically decreasing (increasing) returns from Monday through Friday.

- In fact, Monday (Friday) alone accounts for over 100% of monthly anomaly portfolio returns for which the short (long) side is speculative. For example:

- The four-factor (market, size, book-to-market, momentum) alpha of a long-short idiosyncratic volatility portfolio is 1.63% higher on Monday than on Friday over a month.

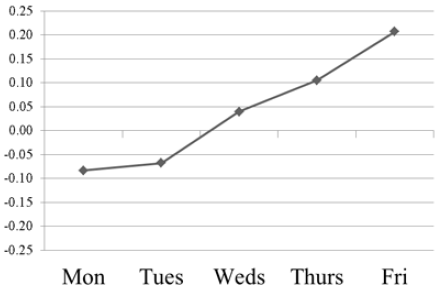

- The four-factor alpha of a long-short size portfolio is 1.22% higher on Friday than on Monday over a month (see the chart below).

- All of this day-of-the-week variation occurs intraday (not overnight).

- In contrast, returns for long-short portfolios for anomalies lacking clear speculative/non-speculative sides (momentum, book-to-market and asset growth) do not vary significantly by day of the week.

- Other sentiment-sensitive market variables corroborate:

- VIX exhibits an average daily increase (decrease) of 2.2% (-0.7%) on Monday (Friday).

- Returns for one-year U.S. Treasury notes are nearly four times higher on Mondays than on Fridays.

- Results are robust across subperiods and to control for economic news, firm-specific news and institutional trading.

The following chart, taken from the paper, tracks average daily excess returns for a long-short value-weighted size portfolio (long small stocks and short big stocks) by day of the week over the entire sample period. The long side of this portfolio is the speculative side. Returns increase consistently from Monday to Friday. Results are comparable for portfolios for other sentiment-sensitive anomalies. Results are also similar for one-factor (market), three-factor (market, size, book-to-market) and four-factor alphas.

In summary, evidence indicates that widely accepted, sentiment-sensitive U.S. stock return anomalies on average vary in strength with investor mood during the week, with risk-off trending toward risk-on.

Cautions regarding findings include:

- Portfolio performance data are gross, not net. Accounting for costs of periodic anomaly portfolio reformation and shorting would reduce performance. Daily entries and exits to exploit day-of-the-week effects would drive large trading frictions.

- Shorting may not be feasible for some stocks in portfolio short sides.