Is there an essential and useful part of investor sentiment independent of any economic and financial indicators that may feed it? In their November 2012 paper entitled “Is ‘Sentiment’ Sentimental?”, Steven Sibley, Yuhang Xing and Xiaoyan Zhang decompose a widely used aggregate investor sentiment index into two components, one related and one unrelated (residual) to common business cycle variables. They then test the ability of each component to predict returns of different kinds of stocks. The sentiment index aggregates the following indicators: closed-end fund discount; market turnover; number of initial public offerings (IPO); first day return on IPOs; secondary equity issuances; and, difference in book-to-market ratios between dividend payers and non-payers. They consider the relationship of this sentiment index to six U.S. economic variables (unemployment rate, change in consumer price index, consumption growth rate, disposable personal income growth rate, industrial production growth rate and NBER recessions) and six U.S. financial variables (3-month Treasury bill yield, default spread, term spread, dividend yield, stock market volatility and stock market liquidity). Using monthly data for all variables during July 1965 through December 2010, they find that:

- Even after eliminating the dependence of each input to the aggregate sentiment index on the NBER recession dummy, consumer durables/non-durables/services growth rate and industrial production growth rate, the sentiment index still relates strongly to contemporaneous economic/financial variables. Led by the 3-month Treasury bill yield and market liquidity, these variables explain about 63% percent of the variation in “purified” sentiment.

- The “purified” sentiment index derives power to predict the cross section of stock returns mainly from its business cycle component. For 28 test strategies that are long and short opposite extremes of specific stock characteristics, this index:

- Significantly predicts returns for 19 of 28 cases, with the business cycle (residual) component significantly predicting 16 (3) of 28 cases.

- Significantly predicts short-side returns for 19 of 28 cases, with the business cycle (residual) component significantly predicting 25 (0) of 28 cases.

- Adding the business cycle component of the “purified” aggregate sentiment index to the Fama-French three-factor model of stock returns significantly improves the model’s accuracy, but adding the residual component does not.

- Similarly decomposing the Michigan consumer sentiment index indicates that business cycle variables explain 74% of its variation, with disposable personal income growth rate and unemployment rate most important.

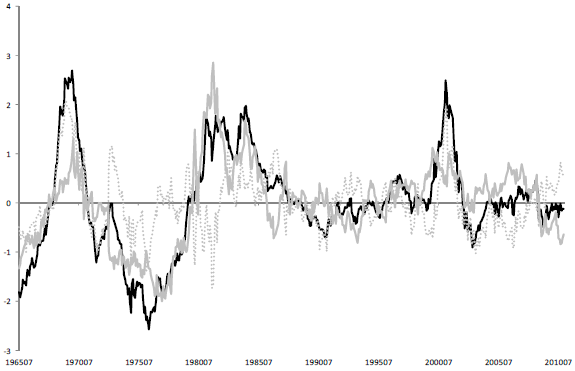

The following chart, taken from the paper, plots the “purified” aggregate sentiment index (dark solid line), the component of this index related to business cycle variables (light gray solid line) and the residual component unrelated to business cycle variables (light gray dotted line) during 1965 through 2010. The two components of sentiment are distinct and often have different signs. Tests undermine belief that investor sentiment offers information about future returns for different kinds of stocks independent of business cycle drivers of sentiment.

In summary, investors should be cautious about interpreting consumer or investor sentiment as an indicator of future financial market behavior independent of contemporaneous economic and financial variables.

Cautions regarding findings include:

- Sentiment may still be a useful reflection of an array of economic and financial variables.

- Tests involve gross, not net, returns. Including reasonable trading frictions, which vary considerably over the sample period and sometimes by kinds of stocks, may affect findings.

See “Aggregate Investor Sentiment and Stock Returns” and “Investor Sentiment and Returns for Different Types of Stocks” for the seminal research.

See also “Purifying Stock Market Sentiment Indicators”, which finds that many sentiment indicators contain no information beyond lagged market action.