“With Thomson Reuters News Analytics, computers can not only read the news – they can interpret it too. The results can enhance your investment and trading strategies, helping you to spot new opportunities and generate alpha. And for the humans among us, news sentiment analysis offers meaningful insight to drive trading and investment decisions.” Is this representation accurate? In his July 2011 paper entitled “News Sensitivity and the Cross-section of Stock Returns”, Michal Dzielinski tests whether returns on positive, neutral and negative news days as indicated by this source are significantly different from the average daily return of a large sample of U.S. stocks. Using Thomson Reuters News Analytics sentiment assessments of novel news items timestamped at least two hours before the stock market close and contemporaneous returns and firm characteristics for covered stocks over the period January 2003 through August 2010 (780-946 stocks per year), he finds that:

- Gross returns of individual stocks on [positive / negative / neutral] news days tend to be [above (+0.45%) / below (-0.43%) / indistinguishable from] average no-news daily returns of sampled stocks.

- There is on average a correct and statistically significant return the day before the news day.

- There no continuation or reversal after news days.

- Infrequent news tends to generate stronger reactions, largely independently of other firm characteristics.

- News sensitivities are greatest (well above 1% news-day gross impact) among smaller and less liquid stocks (perhaps related to the higher informational content of infrequent news) and among low book-to-market and volatile stocks (regardless of news frequency).

- A portfolio that is long (short) the equally weighted fifth of stocks with the highest (lowest) news sensitivities over the past year, reformed monthly, generates a statistically and economically significant gross monthly raw return of 0.95% and a gross monthly four-factor alpha (adjusted for market, size, book-to-market and momentum) of 0.84%. High-impact news items during periods of general uncertainty (such as the recent financial crisis) appear to drive this premium.

- Some industries (such as technology) exhibit higher news premiums than others (such as utilities). Some industries react more strongly to negative news (such as financials) and other more strongly to positive news (health care, oil and gas).

- Results are robust for subsamples, exclusion of earnings announcements and control for past returns.

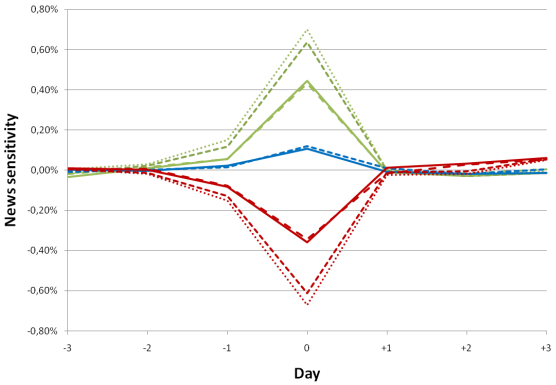

The following chart, taken from the paper, plots daily gross returns from three days before to three days after news day (0). Green, blue and red lines represent positive, neutral and negative news days, respectively. Variations within color relating to full news, headline-only news and market sentiment level as measured by average news sentiment across all stocks.

Results show a significant average news-day reaction matching the news sentiment, with slight anticipation and no subsequent continuation/reversal.

In summary, evidence indicates that stocks reliably react positively (negatively) to good (bad) news, as measured by the Thomson Reuters News Analytics sentiment algorithm, on the release date. Reactions are quick, complete and permanent.

Cautions regarding findings include:

- Return calculations are gross, not net. Including reasonable trading frictions (including an amortized cost for using the Thomson Reuters service) would materially reduce calculated returns. Moreover, stocks with highest news sensitivity are apparently the least liquid, thereby incurring elevated trading frictions and squeezing the exploitable news premium.

- Using daily return data suggests the possibility of mismatches between exact time of news releases and return measurement intervals (making exploitability questionable).

- Statistical significance tests assume well-behaved return distributions. To the extent actual distributions are not well-behaved, these tests lose meaning.