How well do mutual funds exploit theoretical (academic) equity factor premiums, and how well do investors exploit such exploitation? In their January 2019 paper entitled “Factor Investing from Concept to Implementation”, Eduard Van Gelderen, Joop Huij and Georgi Kyosev examine: (1) how performances of mutual funds that target equity factor premiums (low beta, size, value, momentum, profitability, investment) compare to that of funds that do not; and, (2) flow-adjusted performances, indicating how much of any outperformance accrues to fund investors. They classify funds empirically based on factor exposures. Using monthly returns and total assets and quarterly turnover and expense ratios for 3,109 actively managed long-only U.S. equity mutual funds with assets over $5 million (1,334 dead and 1,775 live) since January 1990 and for 4,859 (2,000 dead and 2,859 live) similarly specified global mutual funds since January 1991, all through December 2015, along with contemporaneous monthly equity factor returns, they find that:

- Mutual funds following factor investing strategies outperform conventional actively managed mutual funds.

- 52%, 53%, 52%, 40%, 57% and 60% of low beta, small cap, value, momentum, profitability and investments funds, respectively, generate significantly positive alphas after fees, compared to only 17% of conventional actively managed funds.

- 50% (75%) of low beta and value (small cap, profitability and investment) funds generate positive luck-adjusted net returns. However, only 1% of momentum funds have positive luck-adjusted returns.

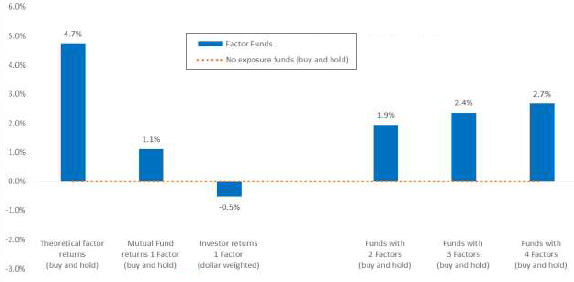

- 1-factor, 2-factor, 3-factor and 4-factor funds generate buy-and-hold compound annual growth rates (CAGR) 1.1%, 1.9%, 2.4% and 2.7% higher on average than the average conventional actively managed fund.

- Results for the global sample of mutual funds are similar.

- However, investors do not capture all factor fund outperformance because they continually reallocate across factors and factor managers (chasing past fund returns). Compared to buy-and-hold, they sacrifice:

- 2.5%, 1.2%, 3.0%, 1.3%, and 0.7% of CAGRs for size, value, momentum, profitability and investment mutual fund performances, respectively.

- 1.7%, 2.3%, 1.4% and 1.7% of CAGRs for 1-factor, 2-factor, 3-factor and 4-factor mutual funds, respectively (see the chart below).

The following chart, taken from the paper, summarizes annualized U.S. sample mutual fund returns (CAGRs) relative to the average for funds with no factor exposures over the full sample period, as follows:

- Theoretical factor returns – average academic (frictionless) buy-and-hold return for the five factors considered above as conventionally calculated for the long side only.

- Mutual fund returns 1-factor – average buy-and-hold returns of mutual funds that target one factor.

- Investor returns 1 factor – average actual returns to investors of mutual funds that target one factor based on fund flows (reflecting investor timing).

- Funds with 2 factors – average buy-and-hold return of mutual funds that target two factors.

- Funds with 3 factors – average buy-and-hold return of mutual funds that target three factors.

- Funds with 4 factors – average buy-and-hold return of mutual funds that target four factors.

Results show that mutual funds targeting equity factors capture part of the theoretical premiums, increasing with the number of factors targeted. Investors do not capture the 1-factor mutual fund outperformance because they adversely time buys and sells and/or pick the worst funds within category.

In summary, evidence indicates that investors can exploit a material fraction of academic factor premiums via buying and holding multi-factor mutual funds.

Cautions regarding findings include:

- The method of identifying factor funds in the study is not available to investors.

- Individuals cannot reliably exploit findings for mutual funds based on average performance because they cannot diversify across many funds.

- Equal weighting of funds may tilt findings toward opportunities with limited capacities (smaller funds exploiting smaller stocks).

See also results for the following sets of exchange-traded funds (ETF):