Which risk-based asset allocation method is best? In their January 2013 preliminary paper entitled “Generalized Risk-Based Investing”, Emmanuel Jurczenko, Thierry Michel and Jerome Teletche present a general framework for risk-based asset allocation depending on two parameters: (1) level of sensitivity to asset return variance and correlation estimates; and, (2) level of tolerance for assets with high return volatilities. Popular strategies such as Minimum Variance (MV, which assumes assets have equal expected returns), Maximum Diversification (MD, which assumes assets have equal expected Sharpe ratios), Equal Weight (EW, which makes no assumptions about expected asset returns or volatilities) and Risk Parity (RP, which assumes assets have equal expected Sharpe ratios and pairwise correlations) are special cases of this general framework. They investigate the theoretical properties of this class of strategies, categorizing them by volatility, market beta, market tracking error, concentration and turnover. They illustrate theoretical conclusions with empirical findings for portfolios reformed monthly based on analysis of a two-year rolling window of individual stock returns. Using mathematical derivations and a large sample of developed market stocks (based on MSCI World composition) during January 2002 through October 2012, they conclude that:

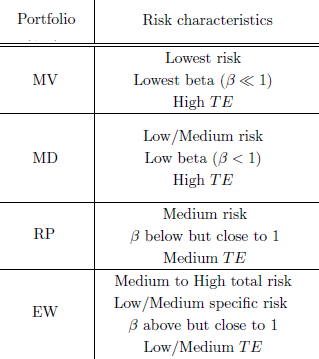

- Theoretically, MV, MD and RP methodologies all prefer low-beta and low-volatility assets, with MV the most defensive. The resulting portfolios (particularly MV and MD) therefore tend to exhibit low beta, low volatility and significant tracking error relative to market portfolios (see the summary table below). More defensive portfolios (especially MV) tend to be very concentrated with high turnover.

- Empirical tests show that:

- MV and MD portfolios do concentrate stocks with low market betas, low absolute volatilities and high market tracking errors. EW and RP portfolios are well-diversified, with market betas near one and low market tracking errors.

- All risk-based methodologies lean toward small-capitalization stocks to some degree, but not toward value stocks. The methodologies are generally not contrarian, though MD leans more toward poor past performers than MV.

The following table, extracted from the paper, summarizes the volatilities (risk), market betas and market tracking errors (TE) of popular risk-based stock allocation strategies. MV and MD portfolios tend to be very concentrated. Portfolio turnover tends to be high for MV and MD, moderate for RP and low for EW.

In summary, theory indicates that risk-based asset allocation strategies vary in (1) sensitivity to asset return volatility and correlation estimates and (2) tolerance to high asset return volatilities, with mean-variance optimization and equal weight representing extremes of risk sensitivity/insensitivity.

Cautions regarding conclusions include:

- The study’s market context and empirical analysis are for equities. Applicability to multiple asset classes is not always obvious (for example, tracking error relative to the market portfolio).

- Investigation of the trade-off between any benefits of risk avoidance and the costs of portfolio turnover would be useful.

See also the closely related “Volatility-based Equity Market Allocations”, “Common Factor Exposures of Specialized Stock Indexes” and “Tests of Strategic Allocations Based on Risk Metrics”.