Are there technical trading rules that persist in profitability, or does the market adapt to extinguish them? In their January 2011 paper entitled “Technical Analysis in the Foreign Exchange Market”, Christopher Neely and Paul Weller review research on technical trading returns in the foreign exchange market during the era of floating exchange rates. They focus on trends in profitability of technical trading rules and examine whether data snooping/mining biases may have been the sources of past findings of profitability. Based on a survey of academic research on technical trading in the foreign exchange market since the early 1970s, they conclude that:

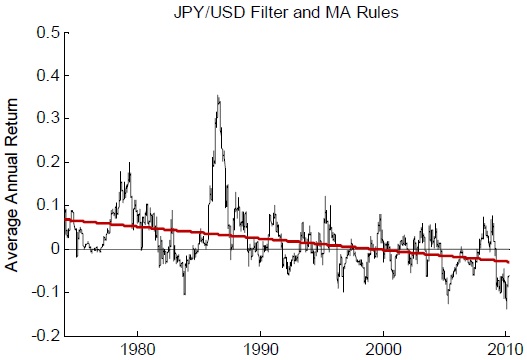

- Out-of-sample tests and adjustments for data mining indicate that simple technical trading rules (moving averages and filters) applied to dollar exchange rates generate positive, risk-adjusted returns for 15 years during the 1970s and 1980s. However, excess returns for these simple rules disappear by the early 1990s (see the chart below).

- Since then, more complex and less studied rules are probably profitable at lower levels.

- The generally declining excess returns to technical trading are consistent with the Adaptive Markets Hypothesis, which posits that learning and competition gradually erode opportunities as they become known. However, the hypothesis does not predict the speed of erosion, time to extinction or the relationship between rule complexity and speed of erosion.

The following chart, taken from the paper, shows one-year rolling average annual returns for an equally weighted set of commonly used filter and moving average trading rules, as applied to the exchange rate between the Japanese yen (JPY) and the U.S. dollar (USD) during 1976 to 2010. Results show that:

- The set of simple technical rules is on average mostly profitable until the early 1990s.

- Since then, the set of rules is on average mostly unprofitable.

- A best-fit linear trend line (red line) for average rule profitability slopes downward, indicating decline in profitability over time. The noisiness of average annual returns demonstrates the difficulty of detecting a trend in technical trading profitability.

The paper includes similar charts for three other dollar exchange rates.

In summary, evidence suggests that some complex and obscure technical trading rules may currently have real value in the foreign exchange market, but the market adapts to widely known rules such that their profitability erodes and even disappears.

It seems plausible that: (1) other financial markets exhibit similar tendencies; and, (2) information technology has accelerated the speed of market adaptation by (a) facilitating dissemination of information about technical trading rules and (b) enabling high-frequency exploitation. A frequently refreshed supply of novel/increasingly complex rules may therefore be critical to long-term success for technical traders. In other words, traders must innovate as fast as markets adapt.