How fast must traders move to operate efficiently in the high-frequency arena? In their February 2012 paper entitled “High-Frequency Technical Trading: The Importance of Speed”, Martin Scholtus and Dick van Dijk investigate execution speed sensitivity of technical trading rule performance for three highly liquid exchange-traded funds (ETF). They consider 27,424 variations of five price-based and two volume-based types of trading rules: moving average; filter; support and resistance; channel break-outs; price momentum; on-balance volume average; and, volume momentum. The baseline analysis constructs new signals every 60 seconds. They measure impact of eight execution delays (10, 20, 50, 100, 200, 500 and 1,000 milliseconds) on profitability relative to instantaneous execution. Trading frictions include bid-ask spread and impact of trading, but not transaction fees. They also measure typical levels of market activity over intervals of one day, one hour, one minute and one second. Using complete order information for SPY, QQQQ and IWM with millisecond timestamp accuracy during normal trading hours for January-September 2009, they find that:

- The average number of messages (mostly to add and delete orders) per second during normal trading hours is 244, 146, and 167 for SPY, QQQQ, and IWM, respectively. The percentages of messages that are actual trades are about 5.8% for SPY, 2.7% for QQQQ and 2.1% for IWM. About 50% of SPY message activity consists orders added and deleted from within one second without executing.

- The level of market activity is typically U-shaped over the day, with a spike at 10:00AM due to macroeconomic announcements and small peaks at full and half hours. Within the typical hour, there is a peak just after the hour and at five-minute intervals. Within the typical minute, there is an initial peak but no other regular pattern. Within the typical second, there is a relatively large peak at 5 milliseconds (ms), smaller peaks around 50 ms and 150 ms and double-peaks at about 250 ms, 500 ms and 750 ms.

- On average, about 72% of the 27,424 rule variations exhibit non-zero performance each day. Of the non-zero outcomes, about 42% (58%) have positive (negative) returns for instantaneous execution, with on-balance volume rules most successful (47% positive).

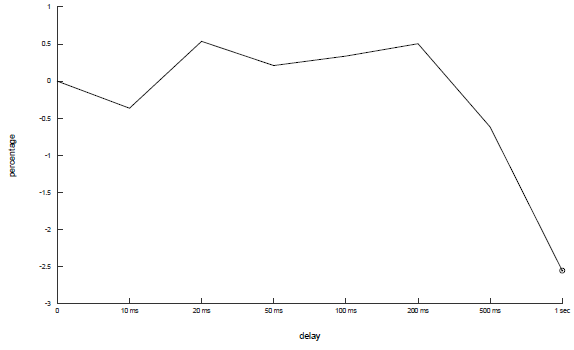

- In general, performance degrades for signal-execution lags greater than 200 ms (see the chart below), driven by rules that generate positive returns when executed instantaneously (thereby engendering trader competition). For this profitable subset, a delay of 200 ms significantly lowers performance on average, with this threshold shrinking to 50 ms on low-volatility days.

- The importance of speed for trading rule performance increases over time.

- Findings are robust across the three ETFs, trade size and length of trade-triggering measurement interval.

The following chart, taken from the paper summarizes the average effect of signal-execution delay on trade profitability (for trades with non-zero instantaneous trade outcomes) across all technical trading rules applied to 100 units of SPY over the entire sample period. Profitability is generally unaffected by a delay up to 200 ms, but progressively declines by about 3% as delay increases from 200 ms to 1,000 ms.

In summary, evidence from the first three quarters of 2009 indicates that speed has a statistically significant (but not economically large) impact on the return of simple technical trading rules.

The authors speculate, but do not demonstrate, that speed of execution is much more important for more complicated interval-based trading rules and rules triggered by some order book events.

Cautions regarding findings include:

- Consideration of 27,424 trading rules on three assets engenders considerable data snooping bias, such that in-sample profitability of a rule may not have material out-of-sample value.

- As noted, profitability accounts for the bid-ask spread and price impact of trading, but not broker fees. Including fees would reduce the number of profitable rules.

- Data collection/processing involved is beyond the reach of most traders.