What are optimal allocations during retirement years for a portfolio of stocks and bonds, without and with a trend following overlay? In their March 2019 paper entitled “Absolute Momentum, Sustainable Withdrawal Rates and Glidepath Investing in US Retirement Portfolios from 1925”, Andrew Clare, James Seaton, Peter Smith and Steve Thomas compare outcomes across two sets of U.S. retirement portfolios since 1925:

- Standard – allocations to the S&P 500 Index and a bond index ranging from all stocks to all bonds in increments of 10%, rebalanced at the end of each month.

- Trend following – the same portfolios with a trend following overlay that shifts stock index and bond index allocations to U.S. Treasury bills (T-bills) when below respective 10-month simple moving averages at the end of the preceding month.

They consider investment horizons of 2 to 30 years to assess glidepath effects. They consider both U.S. Treasury bonds and U.S. corporate bonds to assess credit effects. For comparison of portfolio outcomes, they use real (inflation-adjusted) returns and focus on Perfect Withdrawal Rate (PWR), the maximum annual withdrawal rate that results in zero terminal value (requiring perfect foresight). Using monthly data for the S&P 500 Index, U.S. government and corporate bond indexes and U.S. inflation during 1926 through 2016, they find that:

- Over the full sample period, best allocations with government bonds based on gross Sharpe ratio are:

- Among standard portfolios, 50% stocks and 50% bonds, with gross average annual real return 5.0%, annual volatility 9.0%, gross annual Sharpe ratio 0.50 and maximum drawdown -40%.

- Among trend following portfolios, 70% stocks and 30% bonds, with gross average annual real return 6.7%, annual volatility 7.7%, gross annual Sharpe ratio 0.80 and maximum drawdown -28%. Trend following is materially beneficial only for the stock index.

- Across investment horizons of 30, 20, 10, 5, 3 and 2 years based on PWR with government bonds:

- For standard portfolios with 30-year horizon, 100% stocks generates the highest median PWR (7.5%), with maximum and minimum 12.8% and 3.7% respectively. In other words, outcome depends considerably on date of birth. The highest minimum PWR is for 80% stocks-20% bonds.

- For trend following portfolios with 30-year horizon, 100% stocks again generates the highest median PWR (8.2%), with maximum and minimum 12.3% and 5.1% respectively. In other words, trend following shrinks the best and worst tails of the outcome distribution. The highest minimum PWR is for 100% stocks.

- For conventional 60% stocks-40% bonds, median and minimum PWRs for the standard (trend following) portfolio are 6.0% and 3.6% (6.4% and 4.4%), respectively.

- For standard portfolios, as investment horizon shrinks, median PWRs become relatively insensitive to allocations, and highest minimum PWRs shift from high stocks to high bonds allocations. Results suggest usefulness of glidepath investing (shifting from stocks toward bonds) only for horizons 5 years or shorter.

- For trend following portfolios, both median and highest minimum PWRs become less sensitive to allocations as investment horizon shrinks. In other words, it is safer to maintain high allocations to stocks with trend following than with standard portfolios.

- Substituting the corporate bond index for the government bond index makes little difference, with slightly higher return offset by slightly higher volatility.

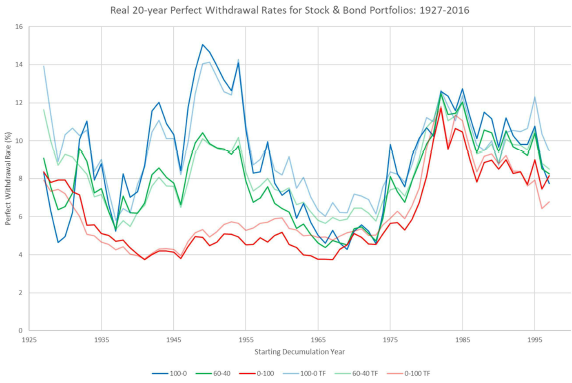

- For 100% stocks, 100% government bonds and 60% stocks-40% bonds across horizons of 30 years to 2 years (see the chart below for a 20-year horizon):

- For standard portfolios:

- 100% stocks generates the highest maximum and median PWRs at all horizons.

- However, 60%-40% has higher minimum PWRs than 100% stocks for horizons shorter than 24 years.

- 100% bonds has higher minimum PWRs than 60%-40% for some horizons shorter than 13 years and all horizons shorter than 5 years.

- For trend following portfolios:

- 100% stocks again generates the highest maximum and median PWRs at all horizons, but maximum PWRs are generally lower than those for standard portfolios.

- However, 60%-40% has slightly higher minimum PWRs than 100% stocks for seven of eight horizons shorter than 10 years.

- 100% bonds consistently has the lowest minimum PWRs.

- Monte Carlo simulations generally confirm results.

- For standard portfolios:

The following chart, taken from the paper, compares PWRs for three standard and three trend following (TF) portfolios for all 20-year investment horizons over the full sample period: 100% stocks (100-0), 60% stocks-40% bonds (60-40) and 100% bonds (0-100). The chart shows that:

- Outcomes vary considerably depending on investor birth date.

- Trend following tends to smooth standard portfolio peaks and valleys, thereby making 100-0 TF relatively attractive.

In summary, available evidence suggests that: (1) diversifying assets over time via trend following is potentially more important for retirement income than diversifying across asset classes; and, (2) glidepath investing is material only for investment horizons of a few years.

Cautions regarding findings include:

- The sample period is short in terms of number of independent investment horizons of lengths greater than a few years. In other words, the sample includes few generational trends in market/economic conditions.

- Returns are gross, not net. Accounting for the costs of maintaining liquid stock and bond funds and for trading frictions associated with monthly portfolio rebalancing would reduce all reported returns. Use of trend following may elevate trading frictions, such that net findings differ from gross findings. Such costs vary considerably over the sample period and were sometimes materially higher than at present.

- As noted, the PWR metric assumes perfect foresight and is likely more aggressive than many investors, requiring a cushion, would entertain.

- Testing many alternative allocations on the same data introduces data snooping bias, with the optimal alternative overstating expectations. Also, the selected trend following lookback interval may inherit data snooping bias from prior research, thereby overstating benefits of trend following.

- As noted in the paper, trend following as specified adds no value for bonds. It may add no value for other asset classes.

See results of this search for related research summaries. See especially “Trend Following to Boost Retirement Income” and “Trend Following for Retirement Portfolio Allocations”.