Can stop-loss rules solve the stock momentum crash problem? In the September 2016 update of their paper entitled “Taming Momentum Crashes: A Simple Stop-loss Strategy”, Yufeng Han, Guofu Zhou and Yingzi Zhu test the effectiveness of a somewhat complex stop-loss rule in limiting the downside risk of a stock momentum strategy. Each month, they rank stocks into tenths (deciles) based on cumulative returns over the past six months, with the top (bottom) decile designated as winners (losers). After a skip-month, they form an equal-weighted or value-weighted portfolio that is long (short) the winners (losers) and hold for one month, except: during the holding month, when any winner (loser) stock in the portfolio falls below (rises above) the portfolio formation price by a basic stop-loss percentage threshold, they next day issue a stop-loss limit order at 1.5 times the threshold. For example, if the basic stop-loss threshold is 15%, the limit order represents an adjusted stop-loss level of 22.5%. If this order does not execute the next day and the original stop-loss threshold is still breached (not still breached) at the close, they sell at the close (repeat the process for that stock daily until the end of the month). They assume funds from any liquidations earn the U.S. Treasury bill (T-bill) yield for the balance of the month. They consider basic stop-loss thresholds of 10%, 15% and 20%. Using daily closes, highs and lows and monthly market capitalizations for a broad sample of U.S. common stocks, daily T-bill yield and monthly Fama-French three-factor (market, size, book-to-market) model returns during January 1926 through December 2013, they find that:

- Over the entire sample period, the conventional equal-weighted momentum strategy:

- Generates average gross monthly return 0.99%, compared to 0.65% for buying and holding the market.

- Has standard deviation of monthly returns 6.01%, compared to 5.43% for the market.

- Produces gross monthly Sharpe ratio 0.17, compared to 0.12 for the market.

- Generates gross monthly three-factor (market, size, book-to-market) alpha 1.27%, with significant negative relationships with the market factor and, especially, the book-to-market factor.

- Suffers worst four monthly losses -49.8%, -39.4%, -35.2% and -34.5%, compared to single worst monthly loss -29.1% for the market.

- Imposing the 15% stop-loss rule on the conventional equal-weighted momentum strategy as specified above:

- Results in liquidations on average of about 10% (11%) of stocks in the long (short) side of the portfolio per month.

- Boosts average gross monthly return to 1.93%. Most of the improvement over the conventional strategy comes from the loser side of the portfolio.

- Reduces standard deviation of monthly returns to 4.61%.

- Increases gross monthly Sharpe ratio to 0.40.

- Boosts gross monthly three-factor alpha to 2.01%, with no significant dependence on any of the three factors.

- Generates worst four monthly losses -17.4%, -14.8%, -13.8% and -13.1%.

- Increases average monthly turnover of the winner (loser) side of the portfolio from 39% to 49% (45% to 59%). Incremental trading frictions are likely much smaller than incremental performance gains.

- Imposing 10% or 20% stop-loss rules similarly boosts gross Sharpe ratio (0.50 or 0.32) and suppresses worst monthly loss (-15.4% or -16.79%).

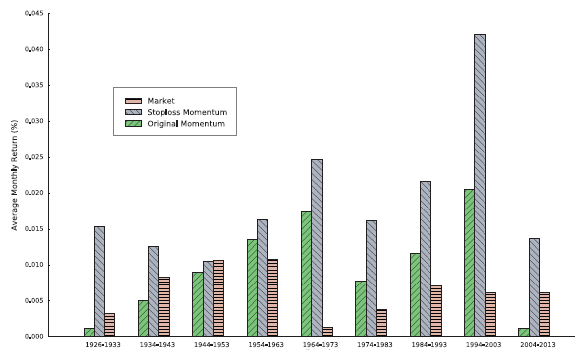

- The stop-loss methodology works across ranges of stock capitalization (size) and liquidity, during economic expansions and contractions, across subperiods (see the chart below), for value weighting of portfolios and for a 12-month momentum measurement interval.

- Different stop-loss execution strategies (trading only on limit order execution, using stop-loss threshold limit order multipliers other than 1.5, and using variable stop-losses based on last-month daily volatility) improve stop-loss strategy gross performance.

The following chart, taken from the paper, compares average gross monthly returns for the broad U.S. stock market (Market), the conventional momentum (Original Momentum) strategy as specified above and the conventional momentum strategy with stop-loss threshold 15% (Stoploss Momentum) as specified above. Results indicate that Stoploss Momentum generally outperforms both Original Momentum and the market.

In summary, evidence suggests that investors pursuing a stock momentum strategy may be able to avoid strategy crashes via a somewhat complex stop-loss rule applied at the stock level between monthly portfolio reformations.

Cautions regarding findings include:

- Reported results are gross, not net.

- Monthly momentum strategies tend to have high turnover, and trading frictions are very high during parts of the sample period (see “Trading Frictions Over the Long Run”). Trading frictions for stocks in stop-loss conditions may be extraordinarily high due to lack of liquidity. Accounting for trading frictions would materially reduce performance.

- Shorting may be costly or infeasible for some loser stocks. (See “Lendable Share Supply a Roadblock to Shorting Strategies?”). Accounting for these issues would reduce performance.

- Reliable stop-loss limit order execution may not have been available over the entire sample period.

- There may be data snooping bias in the momentum measurement interval, the range of stop-loss thresholds considered, the range of multipliers of the stop-loss thresholds used to set liquidation limit orders, the specifications for translating past volatility into variable stop-loss thresholds and other specific stop-loss execution rules, thereby overstating performance expectations.

- Robustness tests partly alleviate this concern.

- However, if overall success of the stop-loss rule depends largely on fitting to a handful of stock market crashes, substantial bias may remain.

- Many investors may not be able to hold/manage enough individual stocks to assure outcome reliability. Delegation to a fund/investment manager adds fees.