What is the best way to capture the slowly realized and variable value premium? In his August 2014 paper entitled “Value Investing: Smart Beta vs. Style Indices”, Jason Hsu compares exploitation of the value premium by traditional style indexes and recent smart beta strategies. Traditional value indexes pick stocks with low price‐to‐book ratios (P/B) and weight them by market capitalization. Smart beta strategies generally ignore stock prices and weight stocks by fundamental metrics such as book values or total cash flows. Using P/B data and returns for broad market indexes, style indexes and smart beta strategies for periods of up to 30 years through the end of 2013, he finds that:

- Major traditional value indexes have poor to mixed results relative to corresponding broad capitalization-weighted market indexes, indicating either that value investing does not work or that the value indexes are ineffective at capturing the value premium. Specifically:

- Over the 30 years through 2013, the S&P 500 Value Index underperforms the S&P 500 Index by a gross 0.18% per year. The Russell 1000 Value Index outperforms the Russell 1000 Index by a gross 0.41% per year.

- Value indexes make significant cross-industry bets, tilting toward sectors that tend to have low P/Bs (financial and energy) and away from those that tend to have high P/Bs (technology).

- Value indexes weight selected components based on market capitalization, thereby having some tendency to rebalance toward overpriced stocks and away from underpriced stocks.

- In contrast, smart beta strategies materially outperform broad capitalization indexes by systematically buying low and selling high via period rebalancing to weights not directly related to price. These strategies also implicitly exploit mean-reverting variability in the value premium. Specifically:

- Over the 30 years through 2013, a fundamentally weighted index outperforms both the S&P 500 Index and the Russell 1000 Index by a gross margin of more than 2% per year. Its gross annualized Sharpe ratio is 0.49, compared to 0.36 for the S&P 500 Value Index and 0.41 for the Russell 1000 Value Index.

- Smart beta strategies emphasize intra‐industry bets, with cross-industry bets meaningful only when entire industries become historically very expensive or cheap.

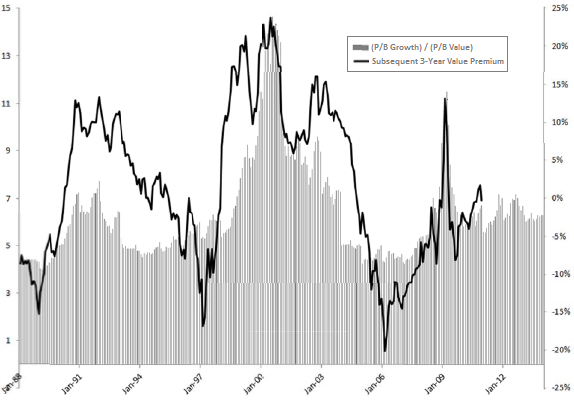

- Smart beta strategy rebalancing rules implicitly exploit variation in the value premium by tilting more toward value stocks when they are cheapest relative to growth stocks (see the chart below).

The following chart, adapted from one in the paper based on an email exchange with the author, overlays two series during 1988 through 2013: (1) the ratio of the average P/B of growth stocks to the average P/B of value stocks [(P/B growth) / (P/B Value)]; and, (2) the annualized value premium over the next three years [Subsequent 3-Year Value Premium]. Results suggest that, when the growth-value relationship is stretched (compressed), the future value premium tends to be strong (weak).

A rebalancing rule that shifts more toward value stocks when value is cheaper compared to growth stocks therefore squeezes more out of the value premium than a rule that simply selects value stocks.

In summary, evidence suggests that smart beta portfolios exploit the value premium more efficiently than capitalization-weighted value indexes.

Cautions regarding findings include:

- Analyses employ indexes/gross smart beta strategies. Including costs of periodic rebalancing and maintaining liquid funds would reduce reported returns. As noted in the paper, since these costs may vary by index/strategy, net findings may differ from gross findings.

- Testing different strategies on the same set of data introduces data snooping bias, such that the best-performing approach likely includes luck and overstates expected performance.