Is there a way to restore confidence in a value premium? In their September 2020 paper entitled “Resurrecting the Value Premium”, David Blitz and Matthias Hanauer seek a reliable value premium via three adjustments to the conventional high-minus-low book-to-market ratio (HML) metric:

- Augment book-to-market ratio with three other value signals: earnings before interest, taxes, depreciation and amortization divided by enterprise value (EBITDA/EV); cash flow-to-price ratio (CF/P); and, net payout yield (NPY), essentially dividend yield plus share buybacks minus share issuance. Create a composite value score by normalizing each metric cross-sectionally (excluding financial stocks) using z-scores and then average individual z-scores.

- For developed markets, impose industry neutrality by independently ranking stocks within each of 11 sectors. For emerging markets impose neutrality at the country level.

- To assure liquidity, consider a universe of all stocks in the standard (large/mid-capitalization) MSCI indexes at that moment. Exploit this liquidity by using equal-weighted portfolios sorted into fifths (quintiles) by composite value score.

Using the specified value metric data, associated stock returns and returns for other standard equity factors as available through June 2020, they find that:

- The conventional HML factor has been weak for decades.

- During July 1990 through June 2020, the annual U.S. value premium is 0.9% overall, -1.4% for large-capitalization stocks and 3.2% for small-capitalization stocks. For small stocks, the premium levels off starting in the mid-2000s.

- For developed-ex-U.S. and emerging markets, annual value premiums among large-capitalization stocks are 1.5% and 2.4%, respectively, both statistically insignificant. Premiums among small capitalization stocks are significant at 5.0% and 10.8%, respectively.

- If this data were available when Fama and French conducted their classic studies, they may have rejected existence of a value premium.

- The enhanced value premium based on composite value score is more convincing than the conventional HML premium.

- In all markets, average returns decrease steadily from the cheapest to most expensive quintiles of stocks.

- During January 1986 through June 2020, annual enhanced value premiums (top minus bottom quintile returns) are 5.5% for the U.S. and 8.3% for developed-ex-U.S. markets. During January 1996 through June 2020, the annual enhanced value premium for emerging markets is 8.8%. All premiums are statistically significant.

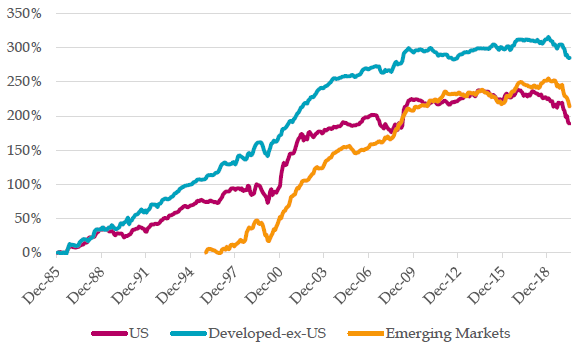

- However, the enhanced value premium also suffers in recent years (see the first chart below).

- The enhanced value premium relates positively to the conventional HML premium and negatively to the conventional momentum premium.

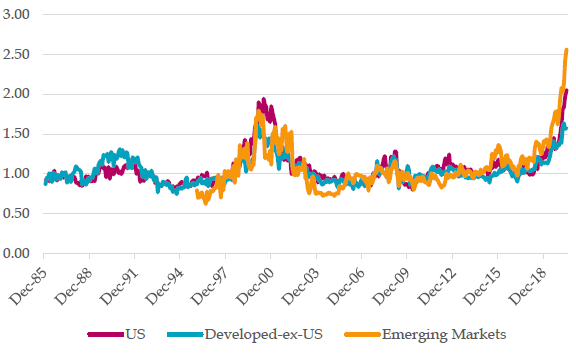

- For the enhanced value metric, as for the conventional metric, the spread in valuation multiples between growth stocks (most expensive quintile) and value stocks (cheapest quintile) reaches a level at the end of the sample period not seen since the late-1990s technology bubble (see the second chart below). The extreme spread implies underestimation of the value premium over the sample period and higher than average expected returns for value stocks.

The following chart, taken from the paper, tracks the cumulative gross enhanced value premium over the available sample period for U.S., developed-ex-U.S. and emerging equity markets. While the long-term trend is up for all three regions, the premium is recently weak and there are pronounced drawdowns at the end of the sample period.

The next chart, also from the paper, tracks the valuation spread between growth and value stocks per the enhanced value strategy for U.S., developed-ex-U.S. and emerging markets. For all regions, there is substantial widening in recent years, suggesting that value stocks may currently be very undervalued.

In summary, evidence indicates that existence of an enhanced value premium is more convincing than existence of the traditional value premium, though the former is still weak in recent years.

Cautions regarding findings include:

- As noted in the paper, the enhanced value premium ignores periodic portfolio reformation frictions, shorting costs/constraints and taxes. Accounting for these costs would lower all returns, differently in different regions.

- The enhanced value methodology is beyond the reach of most investors, who would bear fees for delegating to a fund manager.