Does a simple volatility-based risk management approach substantially enhance performance of a Betting-Against-Beta (BAB) strategy (long stocks with low market beta and short stocks with high market beta)? In their November 2016 paper entitled “Managing the Risk of the ‘Betting-Against-Beta’ Anomaly: Does It Pay to Bet Against Beta?”, Pedro Barroso and Paulo Maio examine a BAB risk management strategy that each month weights assets by a volatility target (12% annualized) divided by daily realized strategy volatility over the previous 21 trading days. For comparison, they apply this risk management approach also to other factor strategies based on their respective daily returns. Using daily and monthly BAB returns from AQR and momentum and factor model returns from Kenneth French covering a broad sample of U.S. stocks during July 1963 through December 2015, they find that:

- Over the sample period, without risk management:

- BAB has gross annualized Sharpe ratio 0.91, compared to 0.38 for the market, 0.27 for size, 0.41 for value (book-to-market), 0.67 for momentum, 0.40 for profitability and 0.53 for investment.

- 1-factor (market), 3-factor (plus size and book-to-market), 4-factor (plus momentum) and 5-factor (plus profitability and investment instead of momentum) gross annualized alphas for BAB are 10.5%, 8.3%, 6.0% and 5.5%, respectively, indicating that BAB is materially different from other major factors.

- However, high BAB and momentum gross Sharpe ratios come with considerable tail risk, manifested by respective maximum drawdowns -52% and -80%, compared to -56% for the market.

- Over the sample period, with the simple risk management approach specified above:

- Gross performance improves for all factors except size.

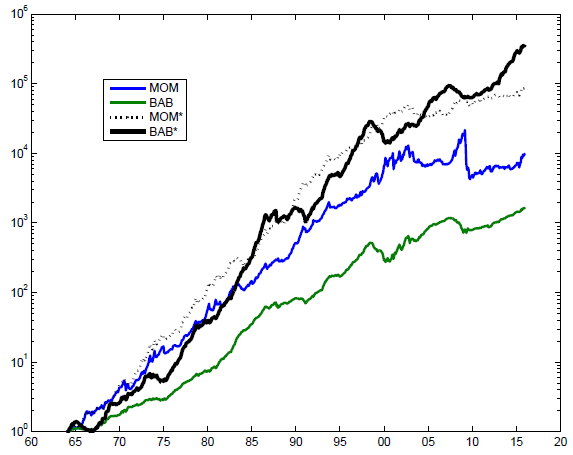

- The biggest improvements by far are for BAB and momentum, with gross annualized Sharpe ratios increasing from 0.91 to 1.28 and 0.67 to 1.08, respectively (see the chart below).

- 1-factor, 3-factor, 4-factor and 5-factor gross annualized alphas for BAB increase dramatically to 21.1%, 18.2%, 15.8% and 16.0%, respectively.

- For both BAB and momentum, improvement stems from strong predictability of strategy risk and lack of reward-for-risk. Gross returns tend to be below average after months with extremely high risk.

- The strategy-specific, not systemic (market), component of risk drives improvements for both BAB and momentum.

- Risk management benefits are robust to measuring volatility over the past six months rather than 21 trading days and to a different way of estimating past volatility.

The following chart, taken from the paper, compares gross cumulative values of $1 initial investments in BAB or momentum factor strategies in July 1963, without or with risk management. At each moment in time, these strategies put all wealth in the risk-free rate and take offsetting long and short positions in BAB or momentum stocks with extremely high and low expected returns. Risk management strongly improves the gross performance of both BAB and momentum, more dramatically for BAB.

In summary, evidence indicates that simple volatility-based risk management greatly improves BAB strategy gross performance, as it does for a stock momentum strategy.

Cautions regarding findings include:

- The selected BAB strategy typically has a larger long side than short side, with the difference funded by borrowing at the risk-free rate (U.S. Treasury bill yield). Borrowing at the risk-free rate may not be feasible.

- Risk management tests assume scaling of positions without constraint, which may not be practicable.

- In general, results ignore trading frictions associated with monthly portfolio reformation and costs of shorting. These costs may be high, especially early in the sample period. Shorting may not be feasible for all specified stocks.

- Portfolio specification and management across a diversified sample of stocks is complex and compute-intensive, thereby beyond the reach of most investors. Delegating these processes involves fees.

See “Avoiding Momentum Strategy Crashes” for a related prior study of stock momentum risk management.