Should investors regard any of the exchange-traded products (ETP) based on S&P 500 Index option-implied volatility (VIX) futures as long-term holdings? In the May 2013 draft of his paper entitled “Trading Volatility: At What Cost?”, Robert Whaley describes these ETPs and evaluates them as buy-and-hold investments. VIX ETPs are based on VIX futures indexes with daily rebalancing, subject to management fees and expenses including commissions and trading fees, licensing fees and (for some ETPs) foregone interest income. Many of the ETPs are exchange-traded notes (ETN), secured not by underlying assets but rather only by the good faith and collateral of the issuer. Using daily price and trading data for VIX futures (starting March 2004) and options (starting February 2006) and for 30 ETPs based on VIX futures (starting January 2009) through March 2012, he finds that:

- ETPs benchmarked to the VIX short-term futures index, such as iPath S&P 500 VIX ST Futures ETN (VXX), are virtually certain to lose money over time. While their returns correlate very negatively to stock market returns, their poor performance renders them ineffective as portfolio diversifiers.

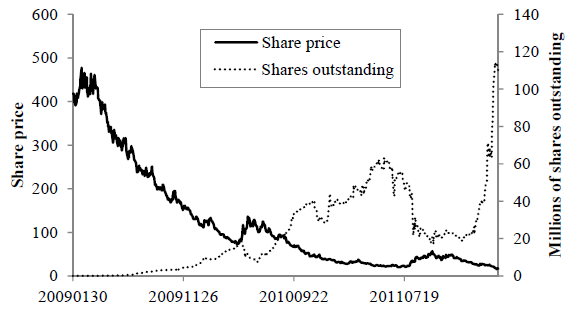

- Over the six years ending March 2012, the VIX short-term total return futures index loses 94% of its value (see the chart below for the corresponding VXX performance).

- Since inception of VIX ETPs, the slope of the VIX futures term structure has increased significantly, thereby elevating the loss rate for this index.

- Over the three years ending March 2012, holders of ETPs benchmarked to this index lost nearly $4 billion.

- Investors may be able to make money by shorting ETPs based on VIX short-term futures, but these securities are relatively difficult and costly to borrow.

- A more practical alternative is to buy and hold an inverse ETP such as VelocityShares Daily Inverse VIX Short-Term ETN (XIV). During December 2005 through March 2012, the inverse of the VIX short-term futures index has a 6.0% annualized return, perhaps accounting for the relatively high institutional ownership in XIV. However, XIV returns correlate very positively with stock market returns, making it a poor portfolio diversifier.

- Those considering ETPs that track VIX as long term holdings should:

- Limit consideration to ETPs based on the VIX mid-term, rather than short-term, futures index. The term structure of VIX futures prices is much flatter for mid-term maturities, reducing losses due to futures contract roll while still offering a very negative correlation with stock market returns. Over the six years ending March 2012, the return for the mid-term (short-term) index is 5.9% (-94%), with -0.77 (-0.78) daily correlation with stock market returns.

- Focus on ETPs that include interest accrual, whether by benchmarking to a total return VIX futures index (such as iPath S&P 500 VIX Medium-Term Futures ETN [VXZ]) or by explicitly offering both the excess return of a VIX index plus accrued interest (such as VelocityShares Long VIX Medium-Term ETN [VIIZ]).

The following chart, taken from the paper, shows the share price and shares outstanding of VXX from inception in January 2009 through March 2012. Although VXX loses 94% of its value, demand for shares is high and generally increasing.

In summary, evidence from the performance of exchange-traded products based on VIX futures indexes suggests that a significant proportion of holders are either ignorant or irrational.

Cautions regarding findings include:

- The March 2012 cutoff for data seems unnecessarily antique.

- Confidence in findings generally depends on the assumption that return distributions are tame enough to support “normal” inference. This confidence degrades to the extent that the distributions are wild. In other words, behaviors that appear irrational when modeled may not be so irrational in reality.

See “Simple Tests of VXX as Diversifier” and “Simple Tests of VXZ as Diversifier”.