Does the S&P 500 Implied Volatility Index (VIX) exhibit exploitable seasonality? To check, we calculate average monthly change in VIX and and average iPath S&P 500 VIX Short-Term Futures ETN (VXX) monthly return by calendar month. Using monthly closes of VIX since January 1990 and monthly reverse split-adjusted closes for VXX since January 2009, both through December 2014, we find that:

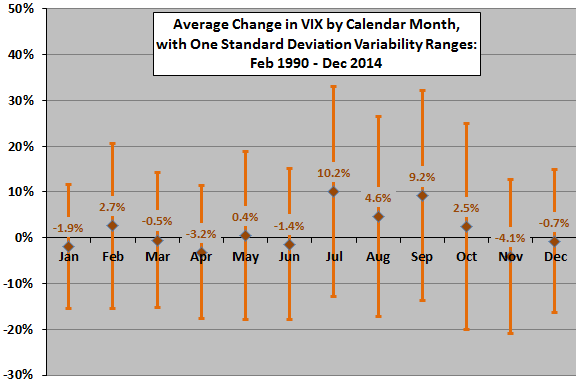

The following chart shows the average change in VIX by calendar month over the available sample period, with one standard deviation variability ranges. Results suggest that VIX tends to increase during the summer months and that it tends to be relatively volatile during July through October.

Is this pattern evident in recent years and in VXX returns?

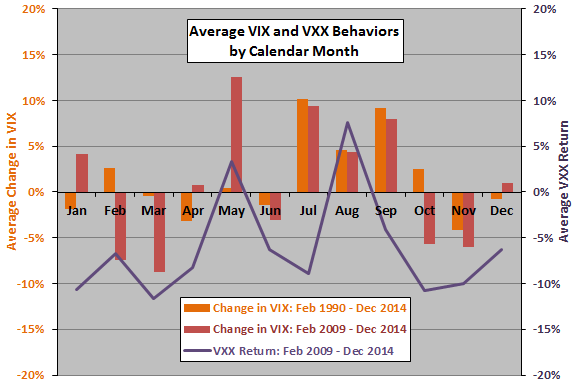

The next chart compares the average change in VIX by calendar month over the entire available sample period and since introduction of VXX in January 2009. It also shows average VXX return by calendar month since January 2009. Results suggest that:

- The tendency of VIX to rise during the summer months is consistent, but inconsistencies during other months between the full sample and recent data undermine belief in reliable seasonable effects.

- VXX returns partly track changes in VIX since VXX inception, but with a pronounced negative bias. VXX returns do not track changes in VIX for July and September.

The subsample since January 2009 (only five years) is extremely short for inference about seasonal effects. Also, VXX incorporates investor expectations for VIX over the next month, so its behavior may differ from that of VIX.

In summary, evidence from simple tests on available data suggests that VIX tends to rise during the summer, but that VXX does not offer a reliable means to exploit this tendency.

Cautions regarding findings include:

- As noted, the subperiod since introduction of VXX is extremely small for analysis of calendar effects. One additional year of data could substantially change findings.

- Change in VIX and VXX return distributions may be significantly wild, such that historical averages and standard deviations are not reliable estimators of future behaviors.

See the broader “Short-term VIX Calendar Effects”. See also the realized volatility patterns in Trading Calendar.